Setting up your spending accounts

Adding spending accounts, such as checking, credit card, savings, and cash accounts, is crucial for gaining financial clarity, effective budgeting, accurate expense tracking, and planning for both short-term and long-term financial goals. It provides a comprehensive understanding of your finances, empowers you to make informed decisions, and ultimately helps you achieve your financial goals.

Which spending accounts should I add?

| Quicken account | Real-world account |

|---|---|

Checking(Tell me how) | CheckingBegin with your primary checking account. This is the account where you deposit your paycheck and pay your bills from. |

Credit Card(Tell me how) | Credit cardStart with the card you use most often, and decide how you want to track your credit card in Quicken.Line of creditUse a credit card account to track a line of credit that isn't a home equity line of credit. (Use a Home Equity Line (HELOC) account instead.) |

Savings(Tell me how) | SavingsAdd your savings accounts, especially if they represent a significant part of your net worth or emergency reserves. You can also use this account type to track any CDs (certificates of deposit) or money market accounts that you hold. |

Cash(Tell me how) | Cash expenditures or petty cashIf you want to know where absolutely all your money goes, or if you need to track petty cash for your business, add a Quicken cash account. (If you do, you can save time by tracking cash expenses only to the nearest dollar.) |

Which spending accounts should I add?

This page is a general guide to adding accounts. If you are having issues/errors adding an account you should visit the Quicken Support Page or contact Quicken Support directly.

To use Quicken you must start by adding your financial accounts. It's easy to add the accounts you want to track in Quicken. The more accounts you add the more closely Quicken reflects your true financial situation, which can assist you in short- and long-term financial planning.

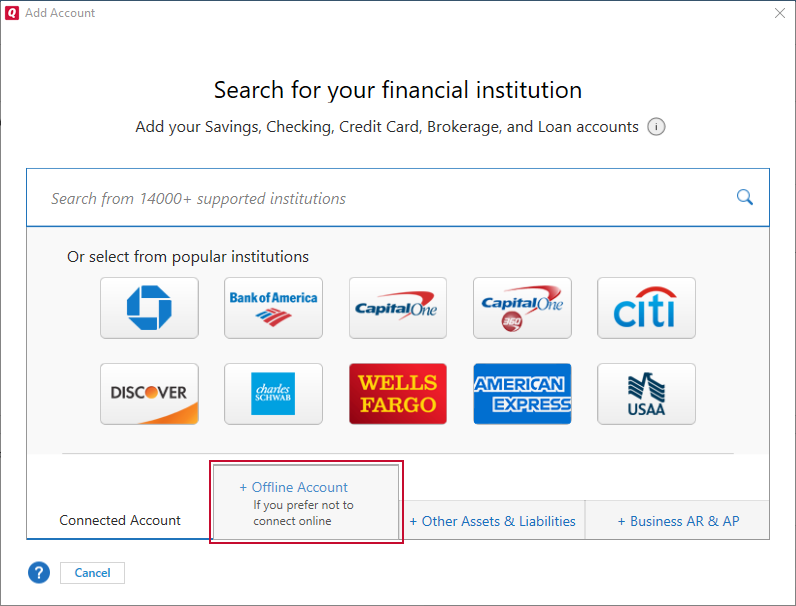

Add an online account

With online accounts, you download your transactions directly from the financial institution. If you do prefer to enter your transactions manually, see Add an offline spending account below.

Select the Add Account

icon on the top right of the Account Bar.

icon on the top right of the Account Bar.

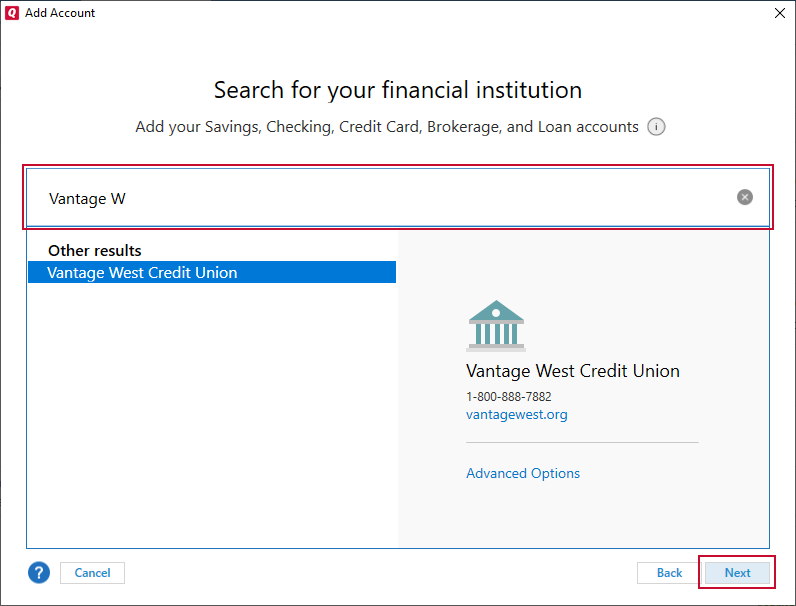

You can also add a new account by selecting Tools → Add Account from the top menu.Start typing the name of your financial institution, such as your bank or credit card provider. Quicken will filter the results based on what you type. When you see your financial institution in the panel below, select it and click Next.

For online accounts, Quicken finds accounts based on the financial institution. This way, if you have multiple accounts at the same bank, you can add them all at once. You will have a chance to select the type of account later.

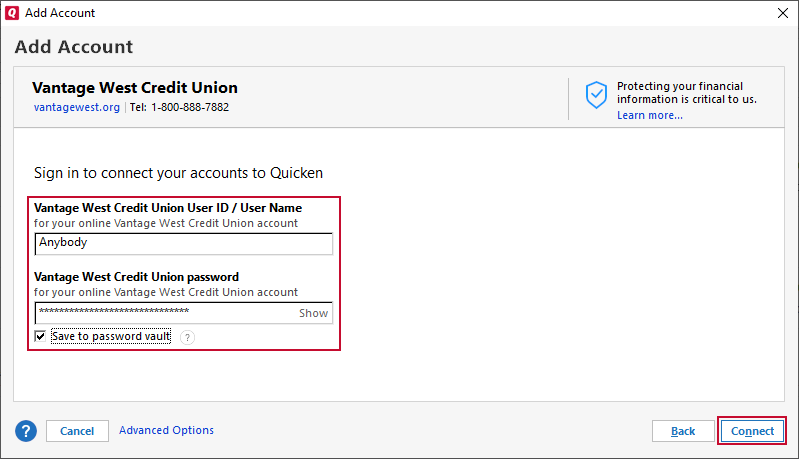

Enter your account/user information. This is the information you use to sign in to your online account, such as a user name and password. you may be asked for additional information, such as a challenge question or a code that is sent to your email or phone.

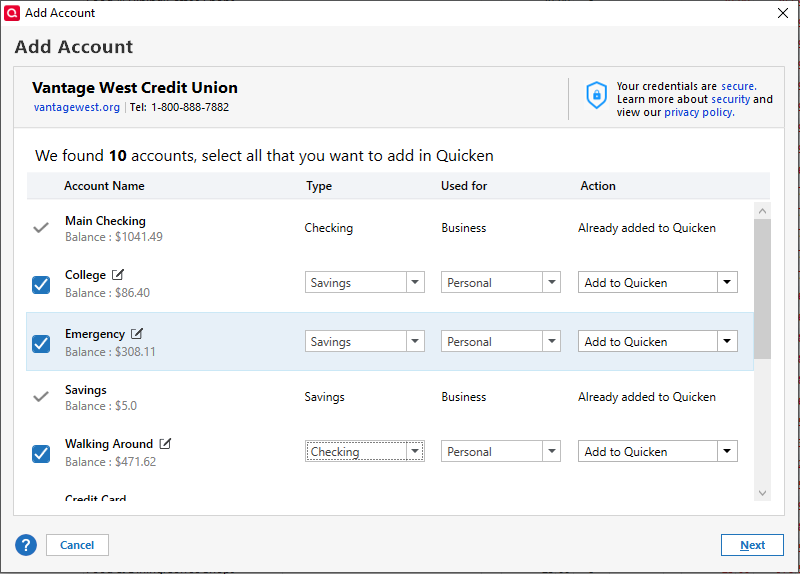

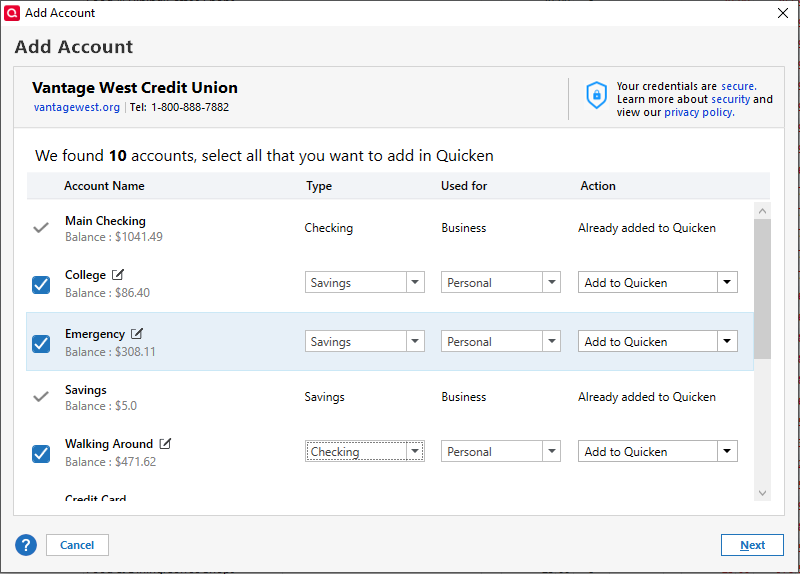

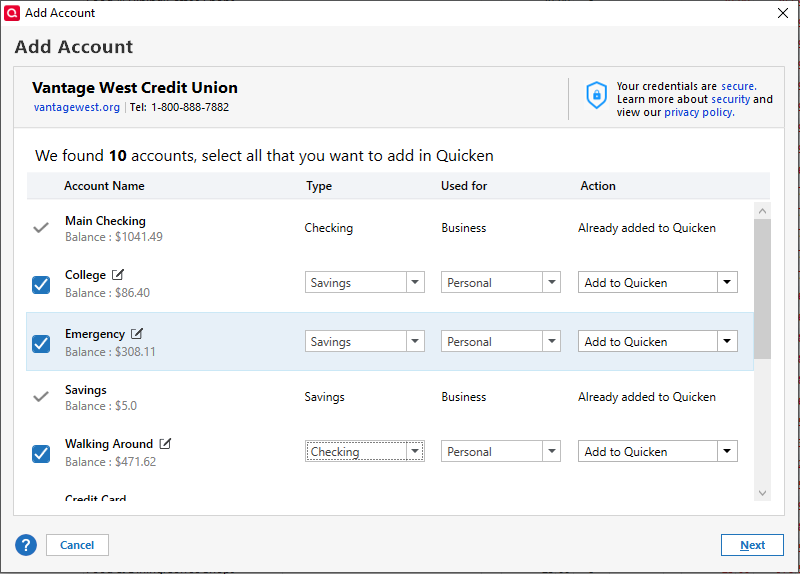

Review your accounts. Quicken finds the accounts associated with your login. On this screen, review the list, make any needed changes, and then click Next.

Account name: Click the edit icon and enter a name that helps you identify the account.

Type: Your options vary by financial institution, but Checking and Savings are common.

Used for: You might not see/need this field. This will only appear for tiers that include Business or Rental accounts. Use Business or Rental to differentiate from Personal accounts.

Action: Choose Add to Quicken to add the account, Don’t add to Quicken to skip it, or Link to existing account to connect it to an account that’s already in your file.

After you sign in to your financial institution, Quicken shows a list of accounts it found so you can choose what to add and make quick adjustments before continuing.

Review your accounts

On the Add Account screen, review the list and confirm each account is set up the way you want.

Select the checkbox next to each account you want to add.

If needed, update the account settings in the row (see the details below).

Click Next.

Accounts already in your file show Already added to Quicken and can’t be added again.

Adjust account details

Use the columns on this screen to make changes before you continue.

Account name

This is the name Quicken will use for the account in your file.

To rename an account, click the account name (or the edit icon) and type a new name.

Type

This is the account type Quicken will create.

Your options vary by financial institution, but Checking and Savings are common.

Used for

This sets how the account is categorized in Quicken.

Most accounts are Personal. Depending on your Quicken version, you might also see Business and Rental.

Action

This controls what Quicken does with the account.

Add to Quicken: Adds the account as a new account in your file.

Don’t add to Quicken: Skips the account.

Link to existing account: Links the downloaded account to an account that’s already in your file.

Quicken now adds your accounts. You'll see a message letting you know what accounts were added. You can choose to either Add Another Account or Finish.

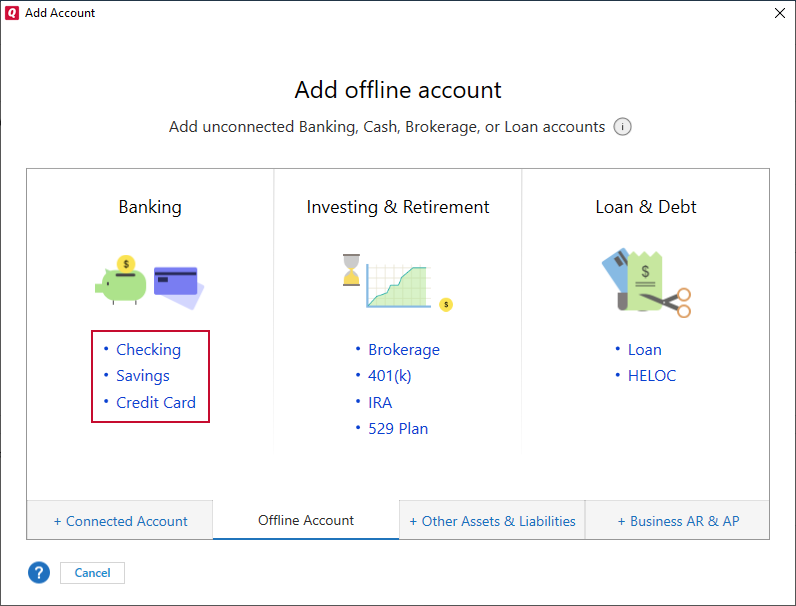

Add an offline account

Offline accounts (sometimes called manual accounts) don't connect to a financial institution. It is your responsibility to enter all the information and track your transactions accurately. In most cases, it is preferable to use an online account, but you may choose this for security, control, or because the account is not with an institution Quicken can connect to.

Select the Add Account

icon on the top right of the Account Bar.

icon on the top right of the Account Bar.

You can also add a new account by selecting Tools → Add Account from the top menu.

Select Offline Account.

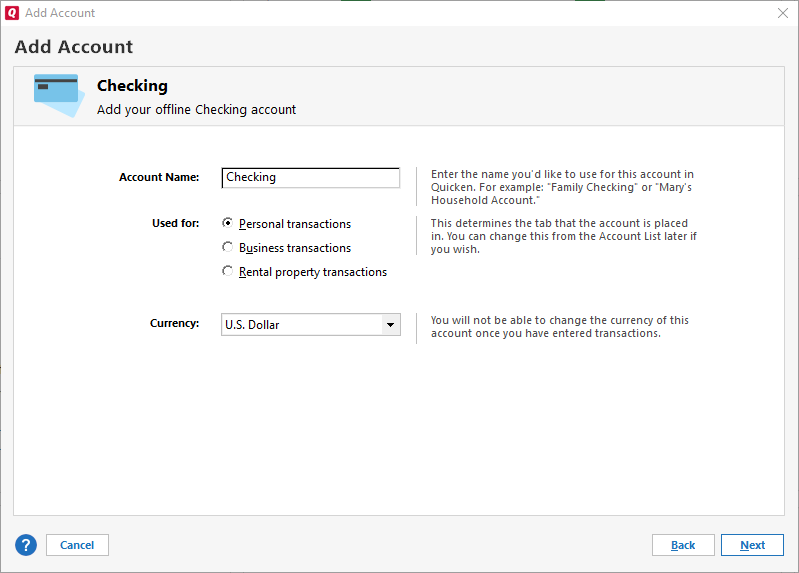

Select the account type. Spending accounts include Checking, Savings, and Credit Card.

Name your account and select Next. Depending on your version of Quicken, you may also have options for selecting how your account is used.

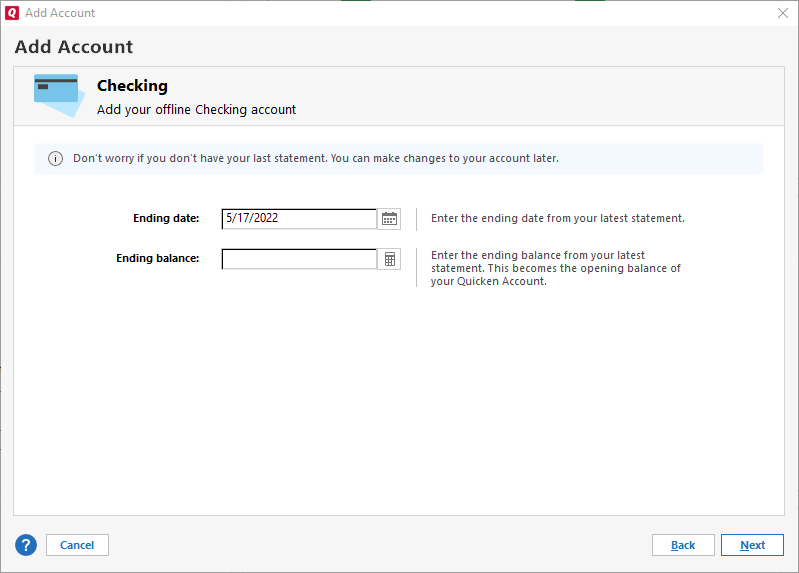

Enter your Statement ending date (The date you want to start tracking from) and your Statement ending balance (how much was in your account that day). Select Next.

Your account will be added. Select Finish. You can also choose to Add Another Account.