If your balance is incorrect

Typical issues with account balance

The account balance will only display correctly if the following conditions are met:

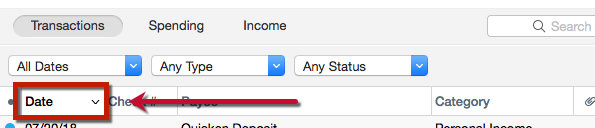

The account register must be sorted by Date (ascending or descending). To sort by date, click on the Date column header.

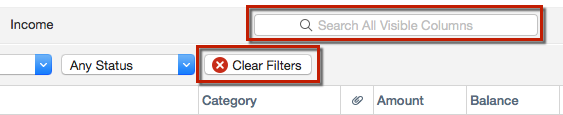

No filters are selected and the Search field is blank. Clear or reset the filters and Search fields.

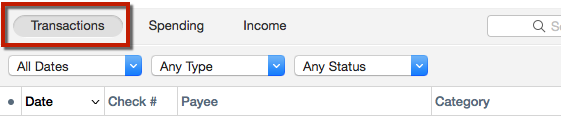

The Transactions view of the register must be selected, not the Spending, Income or Portfolio views.

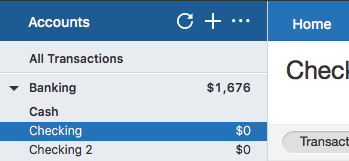

There is only an individual account selected, and not a combined account view such as All Transactions, Cash & Credit, Credit Cards, etc.

Other solutions

Review the import log:

When you import your data, Quicken creates a log of all the tasks it performs during the import process. (In Quicken, choose Help > Show Logs in Finder and look for the Import logs).

Most of the log entries consist of perfunctory information that you can ignore. But the log also lists any problems the program encountered during the import. Check the log for any potential errors, especially ones that say Quicken couldn't import certain data.

Check for "orphaned" transfers.

When you transfer funds from one account to another in Quicken, two transactions are created: one in the account the money came from and one in the account the money went to. When Quicken imports your data, it tries to identify both sides of the transfer. If it can't identify the match, it logs each side of the transfer individually and then creates new matching transactions to complete the transfer. This can result in duplicate records.

For example, suppose you made a $1,000 transfer from Account A to Account B. If Quicken can't identify that the transaction for the withdrawal from Account A is the match for the transaction for the deposit in Account B, then it creates one transaction for the withdrawal it found in Account A, and it creates a new match for the deposit in Account B. At the same time, it creates a transaction for the deposit that it found in Account B and a new match for the withdrawal from Account A. As a result, the withdrawal gets logged twice in Account A, causing the account's balance to be $1,000 less than it should be. And the deposit similarly gets logged twice in Account B, causing that account's balance to be $1,000 more than it should be.

To fix this, simply identify the orphaned transfers and delete the duplicates.