How do I edit an account?

Choose Tools menu > Account List.

Click the Edit button next to the account you want to change. The Account Details dialog displays.

Change the account information, as necessary.

Is there anything I can't change from this window?

You can't edit the Financial Institution (name) field for any account that is activated for online services.

You can't edit the Routing Number, or Customer ID fields for an account that is activated for online services using Express Web Connect.

If you need to make changes to any of these fields, first deactivate online services, make changes, and then reactivate online services. (See Step 4.)

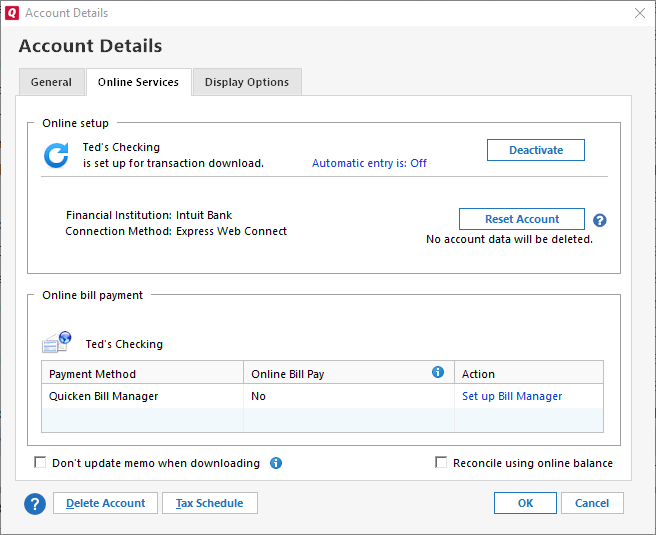

To activate, deactivate, or reset online services, click the Online Services tab of the Account Details dialog.

To activate an account for online services

Click the Set up now button for the online service you want. If your account is already activated (it usually is) then you will only see the Deactivate button.

To deactivate an account for online services

Click the Deactivate button to disconnect your account from online services. You can then make changes to Account Details such as the routing number or the Customer ID.

To reset or repair the connectivity of an online account

Click the Reset Account button. Quicken will automatically deactivate and reactivate the account to fix any errors. Your data remains intact and you can access the account at any time.

What is the difference between deactivating an account and resetting an account?

Deactivate fully disables your connection with the financial institution, stopping all deactivated accounts from communicating with your financial institution or downloading transactions. You should avoid doing this unless it is recommended as part of error-specific troubleshooting.

Reset is like a “soft deactivate”. It resets the connection without making you re-enter your login credentials or go through Deactivate/Reactivate. You will still need to enter your password to reset your account if it is a Direct Connect account and the password is not stored in the vault. You should usually try this before using Deactivate.

To prevent your memos from being overwritten when downloading transactions, select Don't update memo when downloading.

To hide or close the account, or move the account from one account group to another, click the Display Options tab.

To change the tax information for this account, click Tax Schedule.

When done, click OK to save your changes.

Notes

To update a 401(k) account

For 401(k) accounts, see Entering updates to a 401(k)/403(b) account. Depending on how you set up the account in Quicken, it may be preferable to use the 401(k) Update wizard to make changes to an existing account.

To make changes to a loan

For changes to a loan, the recommended procedure is to edit the loan.

To add a linked checking account

You can use the Account Details dialog to add a linked checking account for most types of existing investment accounts. Quicken prompts you to back up your data file before the linked checking account is created.

To convert a brokerage account to a 401(k) or IRA account

If you have been tracking your 401(k) or IRA in a Quicken brokerage account, you can easily convert it to a Quicken 401(k) or IRA account. Doing so will more accurately identify the purpose of the account in Quicken, and assure that its tax-deferred status is represented correctly in Quicken reports and graphs.

To convert a brokerage account to a single mutual fund account

You can change a brokerage account into a single mutual fund account only if the brokerage account contains a single security and no cash balance. To change a brokerage account into a single mutual fund account:

Choose Tools menu > Account List.

Click the Edit button next to the brokerage account you want to change.

In the field next to Single mutual fund account, change No to Yes.

For brokerage accounts, the Single mutual fund account control appears in the dialog only if the account contains a single security and no cash balance.

To convert a single mutual fund account to a brokerage account

You can change a single mutual fund account into a brokerage account, but once you change it, you can't change it back if it contains more than one security or a cash balance. To change a single mutual fund account into a brokerage account:

Choose Tools menu > Account List.

Click the Edit button next to the single mutual fund account you'd like to change.

In the field next to Single mutual fund account, change Yes to No.