Banking / Spending

Use the Spending tab to manage transactions and balances by linking your financial institutions to Quicken. Make online payments and track bills electronically. This section focuses on the tools available to monitor your personal income and expenses. If you are using Quicken Business & Personal, you will have access to additional tools to track business income and expenses.

You can find the Spending tab along the top bar.

This section goes into more depth about the following:

Add an Account

Start using Quicken by adding your financial accounts. It's simple to add the accounts you want to track. The more accounts you add, the more closely Quicken reflects your overall financial situation, helping you with short-term and long-term financial planning.

About Spending Accounts

Keep your spending accounts up-to-date by updating online account balances and cleared transactions from financial institutions such as banks and credit card companies.

Update Your Online Accounts

Use One Step Update to quickly update your online accounts, which may require entering your Vault password. You can also learn how to access your log files in case of an issue.

About Hiding, Separating, and Closing Accounts

Hiding an account in the account bar does not impact reporting or other features. To exclude an account from reporting and other features, it must be marked as separate. Closing an account is irreversible, but if an error occurs, you can restore a backup to undo the closure.

Using the Account Register

The account register in Quicken lists all transactions. Whenever there is a change in spending, deposits, transfers, or any other adjustment, it will be reflected in your account register, which you can access via the account bar by clicking All Transactions or a specific account.

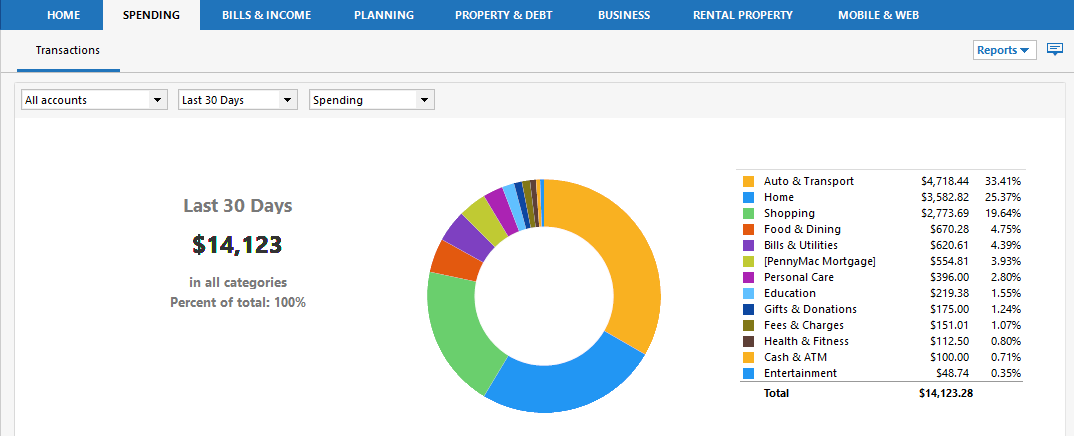

Using Categories

Categories are assigned to transactions in Quicken when they are downloaded from your bank, or they are listed as Uncategorized. Quicken attempts to identify why a transaction was made, such as categorizing a transaction as Groceries if money were spent at a supermarket. Categories are used to power many Quicken features, including spending tracking and budget creation, by allowing you to identify and monitor spending in specific categories.

Transferring Money Online

With Direct Connect, and if your financial institution supports it, you can transfer money between online accounts that share the same customer ID number and are at the same financial institution. This section covers online transfers. You can create an online transfer, find out if it has been completed, or cancel it.

Reconciling Banking Accounts

When reconciling a spending account, you compare your Quicken account records with your current bank statement to resolve any discrepancies. The reconciliation accuracy may be impacted by transactions that took place within the period shown on your bank statement, as well as earlier transactions.

Tracking Your Credit Cards

Download transactions, verify or assign categories, and accept them into your Quicken register.