Sidebar settings

The Sidebar in Quicken for Mac gives you quick access to your accounts and balances. The Sidebar settings let you control which accounts are visible, which balances are shown, and how account groups are displayed. You can open Sidebar settings from Quicken menu > Settings > Sidebar, or from the three-dot menu at the top of the Sidebar.

Account activity indicators

Choose how Quicken notifies you about account activity by showing blue dot indicators in the Sidebar.

Highlight accounts with new transactions – A blue dot appears until you view the account.

Highlight accounts with unreviewed transactions – The dot stays until you mark all transactions as reviewed.

Displayed balances

Choose which balance appears next to each account in the Sidebar.

Today’s Balance – The current register balance based on entered transactions.

Projected Balance – The expected balance after upcoming bills and income.

Online Balance – The last downloaded balance from your bank.

You can also switch balance types from the Sidebar’s three-dot menu.

View options

These settings control what types of balances and totals appear in the Sidebar.

Account Balances – Shows a balance for each account.

Group Balances – Shows a total for each account group.

Sub-Group Balances – Adds totals for subgroups like Checking or Retirement.

Foreign Balances in Home Currency – Converts foreign balances to your home currency.

Total – Displays a grand total of all visible account balances.

Show Cents – Includes cents in all displayed balances.

Accounts to display

These checkboxes control which types of accounts appear in the Sidebar.

Closed – Show accounts marked as closed.

Hidden – Show accounts marked as hidden.

Separate – Show accounts marked as separate in their own section.

Use these options to include or exclude specific groups of accounts.

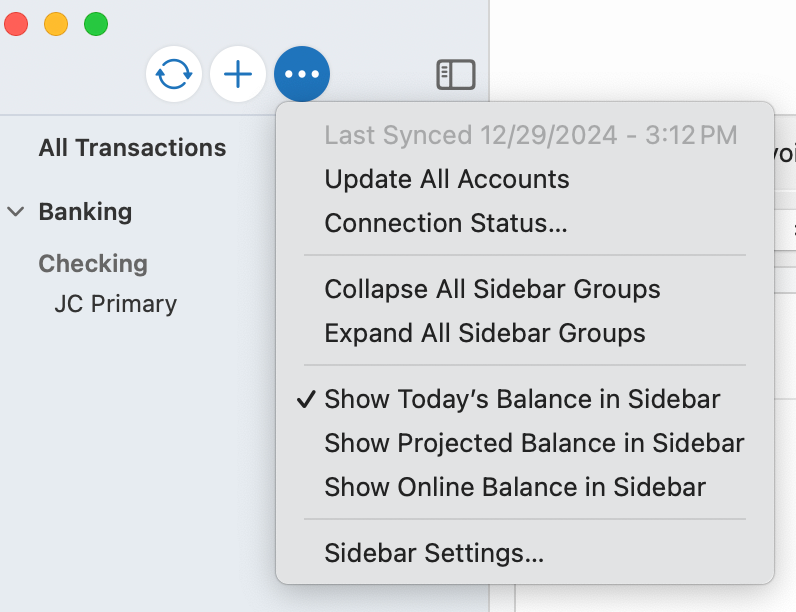

Sidebar quick menu

Click the three-dot menu at the top of the Sidebar to quickly update accounts or change Sidebar settings.

Update All Accounts – Downloads new transactions and balances.

Connection Status… – Opens a window with connection details for your accounts.

Collapse All Sidebar Groups – Minimizes all account groups.

Expand All Sidebar Groups – Expands all account groups.

Show Today’s Balance / Projected Balance / Online Balance – Switches the displayed balance type.

Sidebar Settings… – Opens the full Sidebar settings window.