Adding a new mileage entry

Recording your travel might seem like a small detail, but its really about taking the reins on your financial journey, both professionally and personally. With Quickens New Trip feature, youre not just jotting down miles; youre capturing moments that count towards your business success and personal budgeting. Its a friendly way to ensure every trip—whether its meeting clients or running errands—contributes to a clearer financial picture at the end of the year. Plus, its easier when tax season rolls around and you have all your travel expenses neatly logged and ready to go.

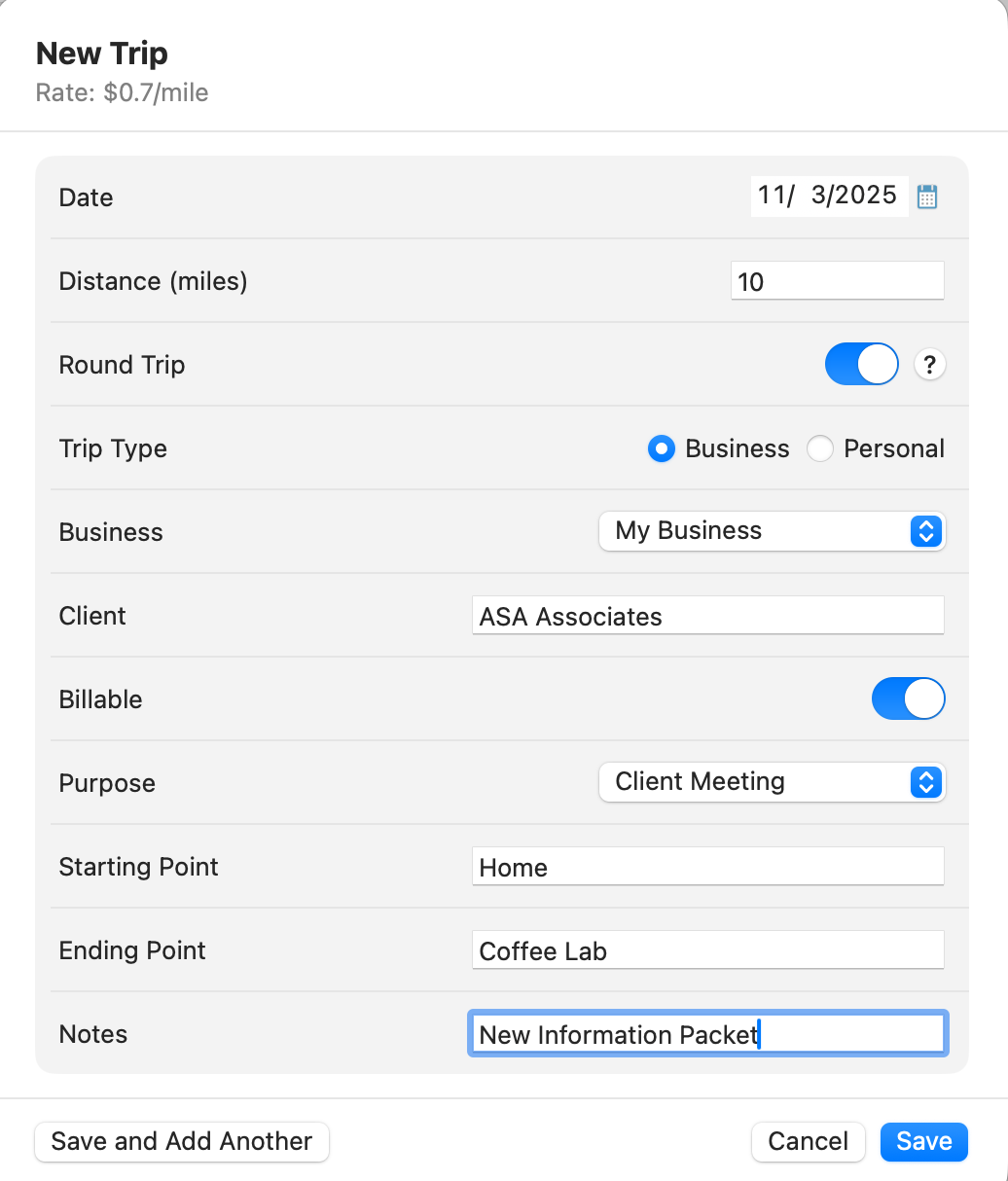

The New Trip feature in Quicken is designed to record the details of business-related travel or personal trips for accurate mileage tracking and reimbursement. Most people will just use the tool to record business trips, but we want you to have the option to see any trips you want to track,

Here is how to use it:

Open the New Trip screen. You can use the New Trip tool from either the Mileage Tracker on the Dashboard or the Mileage Tab.

If you are entering a date other than the same day, select the calendar icon in the Date field to choose the date of your trip.

Enter the total miles traveled in Distance (miles). If you need help with the distance, consider using a map app for more accurate results.

If the trip was a round trip, toggle the Round Trip switch on. This will automatically record two trips of equal distance using the information youve entered.

Specify the trip type by selecting either Business or Personal. This categorization aids Quicken in organizing your trip for reports and deductions.

If the trip is business-related (and you have multiple businesses) select your business from the menu.

Define the purpose of your trip by choosing an option from the Purpose dropdown menu:

Client Meeting

Medical

Pickup / Delivery

Rideshare

Other

Fill out the Starting Point and Ending Point fields with the respective locations of your trip. This is for your own reference, so be sure it is something youll remember.

In the Notes section, add any additional information or important details about the trip. It helps you to remember the trip once its time to do your taxes.

Once all the details are complete, click Save to record the trip. If you have more trips to enter, choose Save and Add Another to continue adding trips without starting over.

Remember, the New Trip tool is there to make keeping track of your travel expenses straightforward and organized, whether its for business audits or personal budgeting.

Tips

Here are some additional tips to help you use the New Trip tool.

Always double-check the date you select on the New Trip form to ensure accurate record-keeping for your mileage logs.

Use a reliable map application to calculate your trip distance if you don't know it offhand, ensuring precision for reimbursements or tax deductions.

Activate the Round Trip feature for any trip where you return to the starting point on the same day to save time on inputting the return mileage.

Clearly distinguish between Business and Personal trips in the Trip Type to maintain organized records, which can be crucial during tax season.

If your trip is for business, make sure to select the correct business entity associated with the trip to streamline financial tracking and reporting.

Utilize the Purpose dropdown to accurately describe the reason for your trip; detailed records can be invaluable for audits or business reviews.

Be specific when entering Starting Point and Ending Point to create a clear log of your travel routes for future reference.

Take advantage of the Notes section to record any additional details or outcomes from the trip, such as client agreements or unexpected expenses.

Remember to save each trip entry as soon as you complete it to prevent any loss of data and use Save and Add Another to efficiently input multiple trips in one session.