Create a bill, income, or transfer reminder

Bill and income reminders make paying your bills a lot easier. When reminders become due, you can choose what happens next—Quicken can simply alert you, or Quicken can enter a transaction into the register for you automatically. When you finish setting up your bill and income reminders, Quicken can project your spending account balances into the future.

Create an Online Bill Reminder

Get reminders for online bills. Enter the login information for the biller's site. Quicken automatically contacts the site and determines amount due and due date based on the information on the site.

Click the Bills & Income tab. Be sure you are either in the Bills tab or (if you have combined tabs) are in the Bills, Income & Transfers tab.

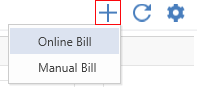

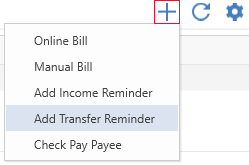

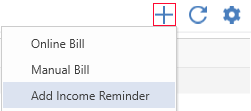

Near the top right side of the screen, select the plus sign and select Online Bill.

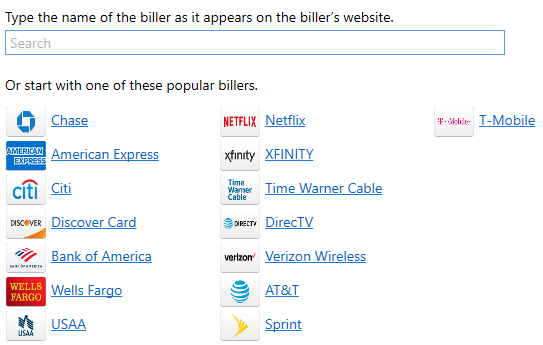

Type in or select the name of your online biller.

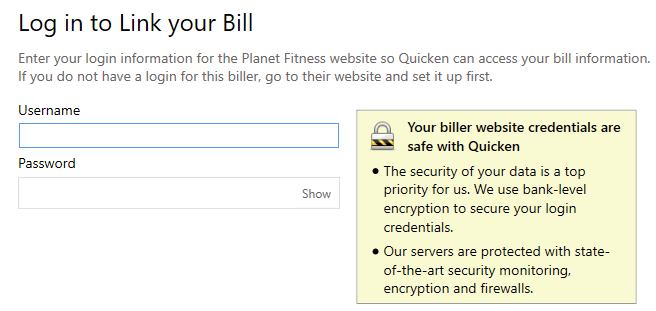

For your online account, enter your login information. It may take some time to process the login and sync the account.

If an error occurs, check your login info and try again. You may want to log in to the payee's website, just to be sure it accepts your information.

Click Done when complete. Your bill is now linked and you will get reminders when the bill is due.

Create a Manual Bill Reminder

Click the Bills & Income tab. Be sure you are either in the Bills tab or (if you have combined tabs) are in the Bills, Income & Transfers tab.

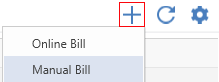

Near the top right side of the screen, select the plus sign and select Manual Bill.

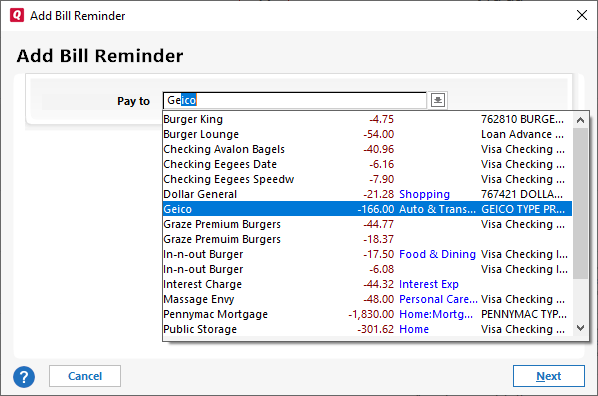

Select or enter a payee. Usually, you want to set up a reminder for an existing payee, which means you can just start typing their name and they should appear. Alternatively, you can enter the name of a new payee.

Enter the key billing information:

Due next on: The next due date for that bill Quicken will base its future reminders on that date. use the Change link to make further adjustments, such as changing How often the bill comes due (such as quarterly or annually) and setting an End date for reminders if the bill is temporary. See Data Options table below.

Amount Due: This is the amount you expect to pay every month. If the Amount Due will change over time either put in your best approximation or, click Optional Settings and edit the Estimate amount for me settings. See step six.

Account: Choose the bank account you expect the money to be withdrawn from.

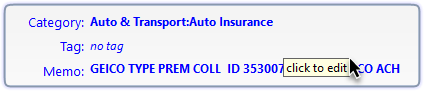

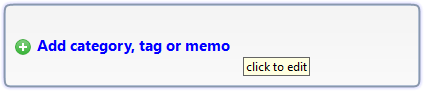

Click inside the Details panel to enter or change any details (Category, Tag, Memo). The split transaction option is available for Category.

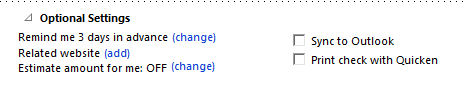

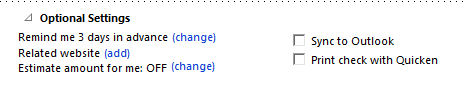

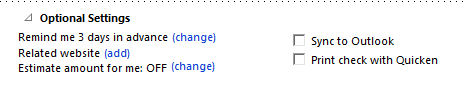

Add or edit the Optional Settings for the reminder.

Remind me [n] days in advance

Remind me [n] days in advance

Select this option to enter the number of days in advance of when the reminder is due that you want to be reminded of it.Automatically enter the transaction in the register [n] days before the due date

Select this option to enter the number of days in advance of when the reminder is due that you want to trigger the reminder and automatically enter it as a transaction in your register.

Use only business days for reminder

Select this option to count only business days when calculating the reminder due date. Quicken will disregard holidays and weekends.

Related website

Select this option to enter a Web address (URL) for the biller or financial institution.

Estimate amount for me

If your payments vary, Quicken can estimate an amount to use for the reminder when it is due. Select one of the following:

Fixed amount. Turn off this feature. Quicken will always use the same amount for the reminder.

Previous payments. Calculate an average amount for the reminder, based on your last [n] payments.

Time of year. Use the same amount as last year for the reminder. This is great for utility bills or other reminders that have seasonal variations.

Credit card balance. Use the balance of the selected credit card as the amount for the reminder.

If you decide to use this feature, an edit icon displays next to the amount in the reminder dialog. Click the edit icon to make further changes, as necessary. Note that this feature is not available for invoice reminders.

Sync to Outlook

Select this option to transfer the reminder to your Microsoft Outlook calendar.

Print check with Quicken

Select this option if you plan to print the transaction on a paper check.

Make this a repeating online payment.

Select this option to create a repeating online payment instruction for the reminder.

Click Done. Your reminder will be added.

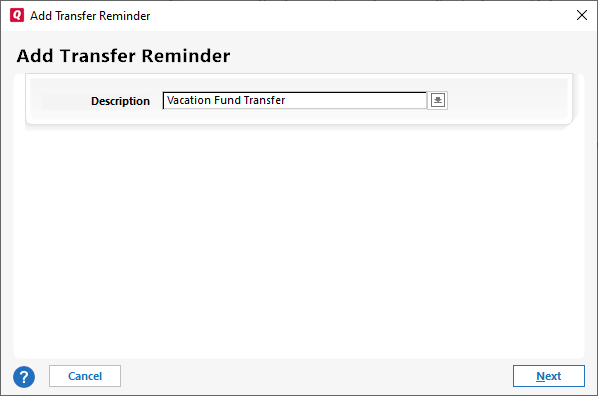

Create a Transfer Reminder

Click the Bills & Income tab.

Be sure you are either in the Income & Transfers tab or (if you have combined tabs) are in the Bills, Income & Transfers tab.

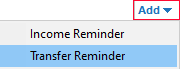

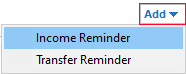

Depending on your tab, you'll have different options for adding a Transfer Reminder.

At the top right of the Income & Transfers screen select Add → Transfer Reminder.

At the top right of the Bills, Income & Transfers screen select the plus sign, then Add Transfer Reminder.

Enter a short Description of the transfer such as Vacation Fund Transfer.

Select Next.

Enter the key transfer information:

Due next on: The next due date for that transfer. Quicken will base its future reminders on that date. Use the Change link to make further date adjustments, such as changing How often the transfer will occur and setting an End date for reminders if the transfer schedule is temporary. See Data Options table below.

Amount Due: This is the amount you expect to transfer every time. If the Amount Due will change over time either put in your best approximation or, click Optional Settings and edit the Estimate amount for me settings. See step 8.

From Account: Choose the bank account you want the money to be transferred from (the source of the funds). You will still need to make the transfer yourself, this is just a reminder.

To Account: w

Click inside the Details panel to enter or change any details (Tag, Memo).

Add or edit the Optional Settings for the reminder.

Remind me [n] days in advance

Remind me [n] days in advance

Select this option to enter the number of days in advance of when the reminder is due that you want to be reminded of it.Automatically enter the transaction in the register [n] days before the due date

Select this option to enter the number of days in advance of when the reminder is due that you want to trigger the reminder and automatically enter it as a transaction in your register.

Use only business days for reminder

Select this option to count only business days when calculating the reminder due date. Quicken will disregard holidays and weekends.

Related website

Select this option to enter a Web address (URL) for the biller or financial institution.

Estimate amount for me

If your payments vary, Quicken can estimate an amount to use for the reminder when it is due. Select one of the following:

Fixed amount. Turn off this feature. Quicken will always use the same amount for the reminder.

Previous payments. Calculate an average amount for the reminder, based on your last [n] transfers.

Time of year. Use the same amount as last year for the reminder. This is great for utility bills or other reminders that have seasonal variations.

If you decide to use this feature, an edit icon displays next to the amount in the reminder dialog. Click the edit icon to make further changes, as necessary. Note that this feature is not available for invoice reminders.

Sync to Outlook

Select this option to add the reminder to your Microsoft Outlook calendar.

Click Done. Your reminder will be added.

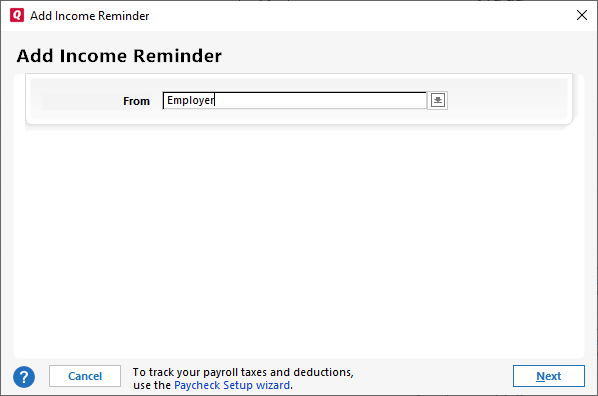

Create an Income Reminder

Click the Bills & Income tab.

Be sure you are either in the Income & Transfers tab or (if you have combined tabs) are in the Bills, Income & Transfers tab.

Depending on your tab, you'll have different options for adding an Income Reminder.

At the top right of the Income & Transfers screen select Add → Income Reminder.

At the top right of the Bills, Income & Transfers screen select the plus sign, then Add Income Reminder.

In the From field enter the name you want to use for your income source. You can also choose from existing payees.

Select Next.

Enter the key income information:

Due next on: The next due date for that income Quicken will base its future reminders on that date. use the Change link to make further adjustments, such as changing How often the income is planned for and setting an End date for reminders if the income schedule is temporary. See Data Options table below.

Amount Due: This is the amount you expect to receive every time. If the Amount Due will change over time either put in your best approximation or, click Optional Settings and edit the Estimate amount for me settings. See step 8.

Account: Choose the bank account you expect the income to be added to.

Click inside the Details panel to enter or change any details (Category, Tag, Memo). The split transaction option is available for Category.

Add or edit the Optional Settings for the reminder.

Remind me [n] days in advance

Remind me [n] days in advance

Select this option to enter the number of days in advance of when the reminder is due that you want to be reminded of it.Automatically enter the transaction in the register [n] days before the due date

Select this option to enter the number of days in advance of when the reminder is due that you want to trigger the reminder and automatically enter it as a transaction in your register.

Use only business days for reminder

Select this option to count only business days when calculating the reminder due date. Quicken will disregard holidays and weekends.

Related website

Select this option to enter a Web address (URL) for the payee or financial institution.

Estimate amount for me

If your payments vary, Quicken can estimate an amount to use for the reminder when it is due. Select one of the following:

Fixed amount. Turn off this feature. Quicken will always use the same amount for the reminder.

Previous payments. Calculate an average amount for the reminder, based on your last [n] payments.

Time of year. Use the same amount as last year for the reminder. This is great for utility bills or other reminders that have seasonal variations.

If you decide to use this feature, an edit icon displays next to the amount in the reminder dialog. Click the edit icon to make further changes, as necessary. Note that this feature is not available for invoice reminders.

Sync to Outlook

Select this option to transfer the reminder to your Microsoft Outlook calendar.

Click Done. Your reminder will be added.

Date Options

There are many options available for setting due dates. These are their descriptions.

Option | Description |

|---|---|

Daily | The transaction repeats every n days, based on the interval you specify. |

Weekly | The transaction repeats every n weeks on a specific day of the week. |

Bi-weekly | The transaction repeats every two weeks on a specific day of the week. |

Monthly | The transaction repeats every n months on a specified date (for example, the 4th) or a specified day (for example, the first Thursday). |

Twice a month | The transaction repeats twice monthly on two specific dates (for example, the 4th and the 15th), or on one specific day plus the last day of the month. |

Quarterly | The transaction repeats four times per year (every three months), based on the specified start date. |

Yearly | The transaction repeats once each year on the specified start date. |

Twice a year | The transaction repeats twice yearly on two specific dates (for example, December 10th and April 10th). Commonly used for property tax reminders. |

Only once | The transaction occurs just one time, on the specified start date. It does not repeat. |

To pay estimated taxes | The transaction repeats on preset tax payment dates when this option is selected. |