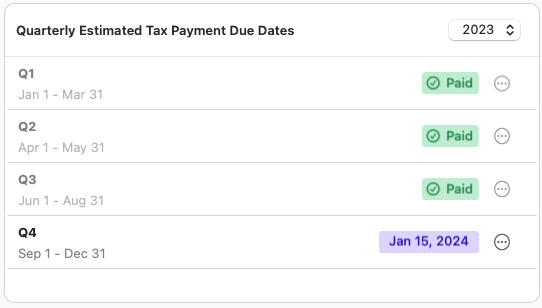

Quarterly Estimated Tax Payment Due Dates

Managing your tax obligations effectively is crucial for self-employed professionals, and the Quarterly Estimated Tax Payment Due Dates feature in the Business Dashboard of Quicken for Mac's Business & Personal (B&P) tier is here to lend a helping hand. This calendar ensures that you stay on top of your quarterly estimated tax payments, allowing you to mark them as paid promptly once you've sent them in. Whether you're a seasoned taxpayer or just starting to grapple with estimated tax payments, this page is your trusted resource for staying organized and on track with your tax responsibilities.

The form is straightforward and exists to help remind you of upcoming tax periods. B&P does not track your payments to the Internal Revenue Service except as categorized transactions (use the category Federal Tax). This form is more of a reminder so that you can remember whether you made the payment.

To mark a quarterly period as Paid, select the three-dot menu