Business Dashboard

The Business Dashboard provides a real-time overview of your business finances in one place. It helps you track income, expenses, upcoming bills, and key financial metrics to manage cash flow and monitor profitability.

By consolidating data from your business accounts, transactions, and reports, the dashboard allows you to quickly assess your financial health without navigating multiple menus. You can also customize the dashboard to display the most relevant information for your business needs.

Accessing the Business Dashboard

Open Quicken Classic Business & Personal for Mac.

Select Business from the tabs at the top of the screen.

Click Dashboard if it is not already selected.

Customizing the Dashboard

You can tailor the Business Dashboard to display the most relevant financial information for your business. By selecting and arranging the sections (cards) that matter most, you can create a personalized view of your income, expenses, and other key metrics.

Adjusting Dashboard Sections

Click the four-square menu icon

to choose which cards to display on the dashboard.

to choose which cards to display on the dashboard.

Customizing Individual Cards

Click the three-dot menu

on a card to access customization options:

on a card to access customization options:Rename the card to reflect its purpose.

Adjust the date range to focus on specific time periods.

Change the card color for better visual organization.

Select specific accounts to refine the displayed data.

These options help you create a dashboard that fits your workflow and business needs.

Understanding the Business Dashboard

The Business Dashboard organizes key financial data into sections (cards) to help you monitor your business performance at a glance. Each section provides insights into different aspects of your finances, from tracking income and expenses to managing tax obligations.

By reviewing these sections regularly, you can stay on top of cash flow, prepare for upcoming bills, and ensure accurate record-keeping. Below is an overview of the key sections available on the dashboa

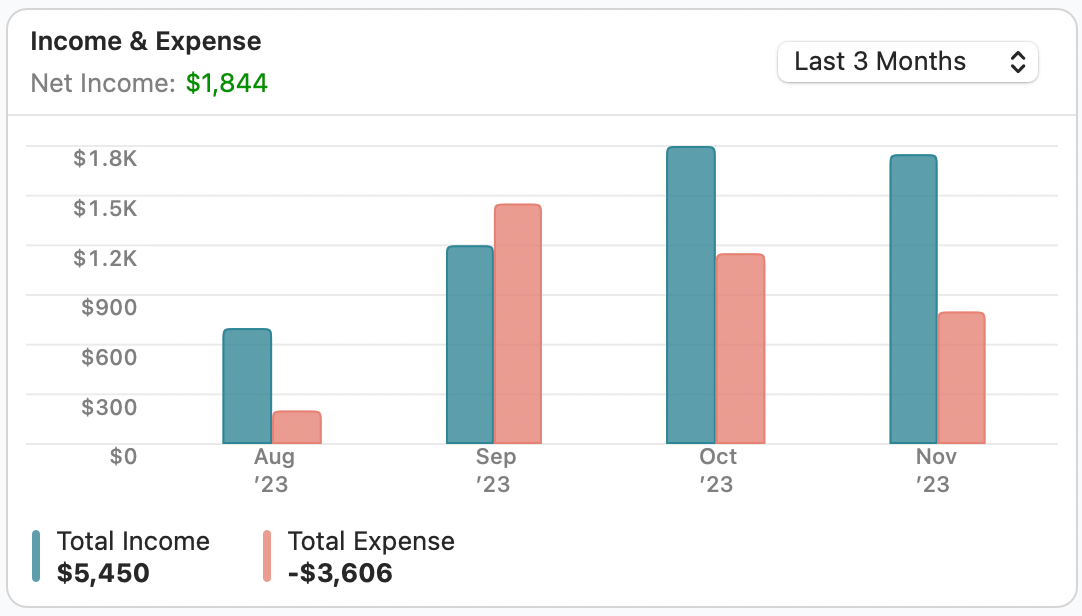

Income & Expense: Your cash flow compass

This section displays all scheduled business expenses and expected income, helping you manage your cash flow. By keeping track of due dates for bills, invoices, and other financial obligations, you can ensure timely payments, avoid late fees, and better plan for upcoming income.

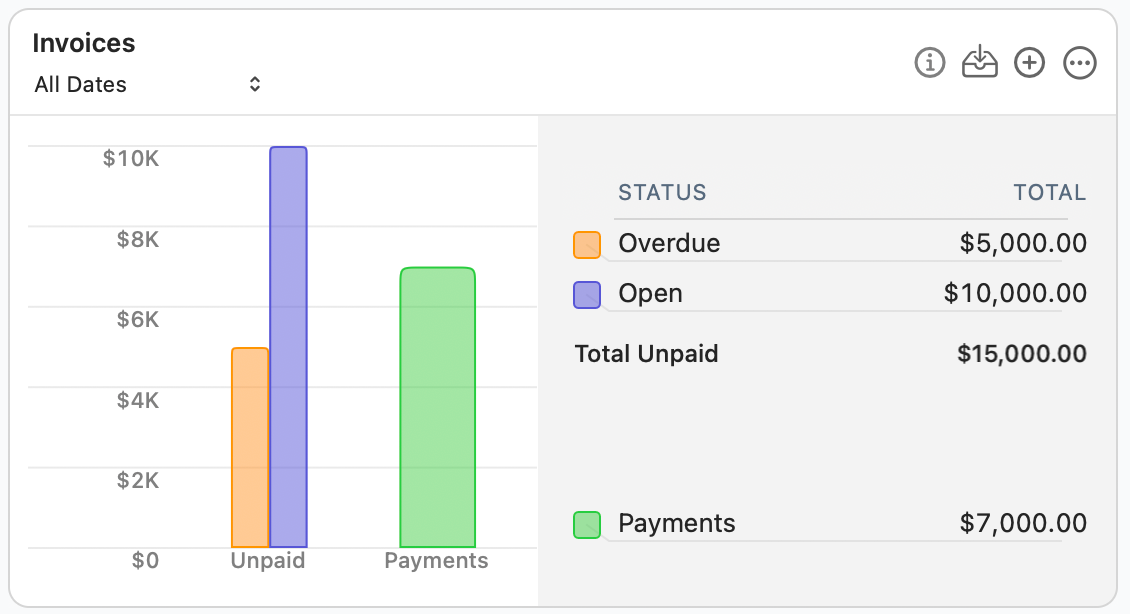

Invoices: Tracking your client billing

This card shows a summary of your invoices, categorized by payment status: Overdue, Open, and Payments received. It provides a visual breakdown of your outstanding and collected invoice amounts. You can click each status directly on the card to quickly view detailed invoices. Use this card to easily track invoice payments and identify overdue client payments at a glance.

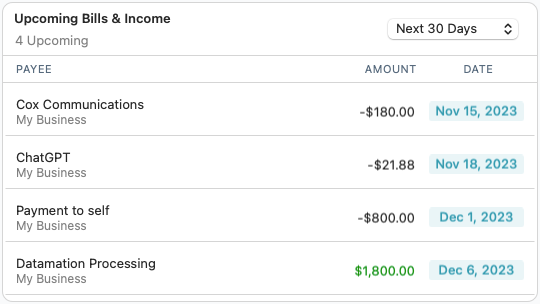

Upcoming Bills & Income: Stay on top of your finances

This section displays all scheduled business expenses and expected income, helping you manage your cash flow. By keeping track of due dates for bills, invoices, and other financial obligations, you can ensure timely payments, avoid late fees, and better plan for upcoming income.

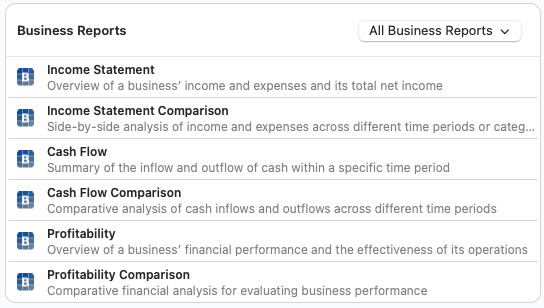

Business Reports: Insights at your fingertips

Access key financial reports, including the Income Statement, Cash Flow Statement, and Profitability Report. These reports provide an in-depth analysis of revenue, expenses, and net income. You can customize report filters to view data by specific time periods or business accounts, making it easier to assess financial health and track business growth.

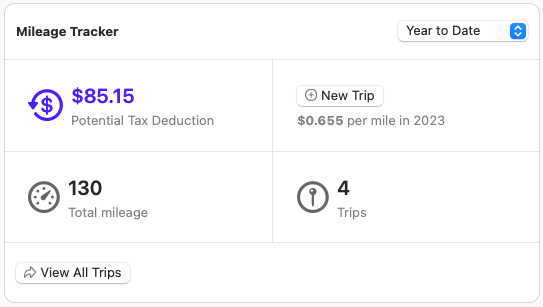

Mileage Tracker: Your road companion

Use this section to log business-related mileage for tax deductions or reimbursement. Enter trip details such as date, distance, and purpose to maintain accurate records. Proper mileage tracking helps maximize deductions and ensures compliance with tax reporting requirements.

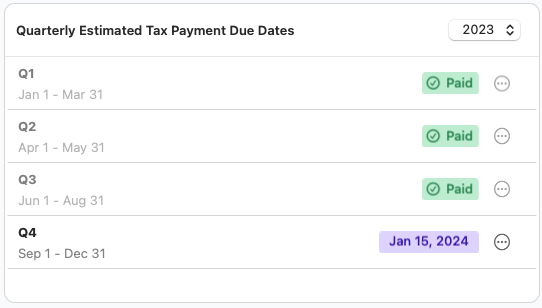

Quarterly Estimated Tax Payment Due Dates: Stay on top of your tax obligations

Stay informed about upcoming tax deadlines with this section. It tracks estimated quarterly tax payment due dates, helping you avoid penalties and plan for tax obligations in advance. Keeping an eye on these deadlines ensures that you set aside the necessary funds and meet tax compliance requirements.

Why is business information missing from the Business Dashboard?

If your Business Dashboard is missing data, such as transactions, or if it has incorrect income and expense details, there are steps you can take to verify its accuracy. Let's explore what you can check to ensure all your business data is correctly reflected in the Business Dashboard.

Business Categories

The Business Dashboard only displays data from transactions categorized with a business category. If a transaction does not appear in a dashboard card as expected, check the transaction’s details to ensure:

The assigned category is a business category.

The Business field includes your business name. The default is My Business.

Business categories require the Business field to be filled out. If you're unsure whether a category is a business category, follow these steps:

Go to the Window menu and select Categories.

Search for the category using the seach field.

In the Type column, check whether it is labeled Business Income or Business Expense.

If it is not a business category, edit the category and set the Usage to Business.

About business categories

Changing the Usage setting of a custom category from Personal to Business, or vice versa, updates all transactions assigned to that category. Because of this, default business categories have the Usage option disabled and cannot be changed.

Use Business categories only for business-related transactions and Personal categories only for personal expenses.

Business filter

If you manage multiple businesses, you can filter the Business Dashboard to display data for a specific business or all businesses combined.

Select the appropriate business filter to display the data you need.

If the dashboard is filtered to a specific business, ensure the Business field in the transaction matches that business name.

Business Dashboard card filters

Each dashboard card has a date filter in its header. Adjusting the filter allows you to view data within a specific date range.

If a transaction does not appear in the expected dashboard card, check whether it falls within the selected date range.

Business reports

Tax Schedule Reports require that transactions use business categories assigned to a tax-related form matching the report type.

For example, if you generate a Schedule C business report, the business categories in your transactions must have a Schedule C tax reference.

Assigning tax references to business categories

When you create a Business and select a Business Type (Schedule C, E, or F), the system displays categories that match the business type. If you create custom business categories, enable the Tax-Related option and specify the correct Form and Tax Line to ensure tax-related transactions appear in reports.

Verify or Edit a Category’s Tax Reference

To verify whether a business category has the correct tax reference:

Open the Window menu and select Categories.

Search for the category using the seach field.

Check the Tax Form column:

If the category is tax-related, the corresponding Tax Form(s) will be listed.

To edit the category, double-click it

Modify the Tax Line or tax relationship as needed.

Click OK (or press Return).