Adding a Lending Loan account

You can add a Lending Loan account to track loans you have provided to others. This feature allows you to track the money you’ve lent to others and monitor repayment schedules efficiently. By setting up a Lending Loan account, you can easily manage and track the status of your loans, ensuring you have a clear overview of your finances.

How to add a Lending Loan account

Go to Accounts → Add account (Or click the + sign on your sidebar)

Select Offline Account → Lending Loan (under assets).

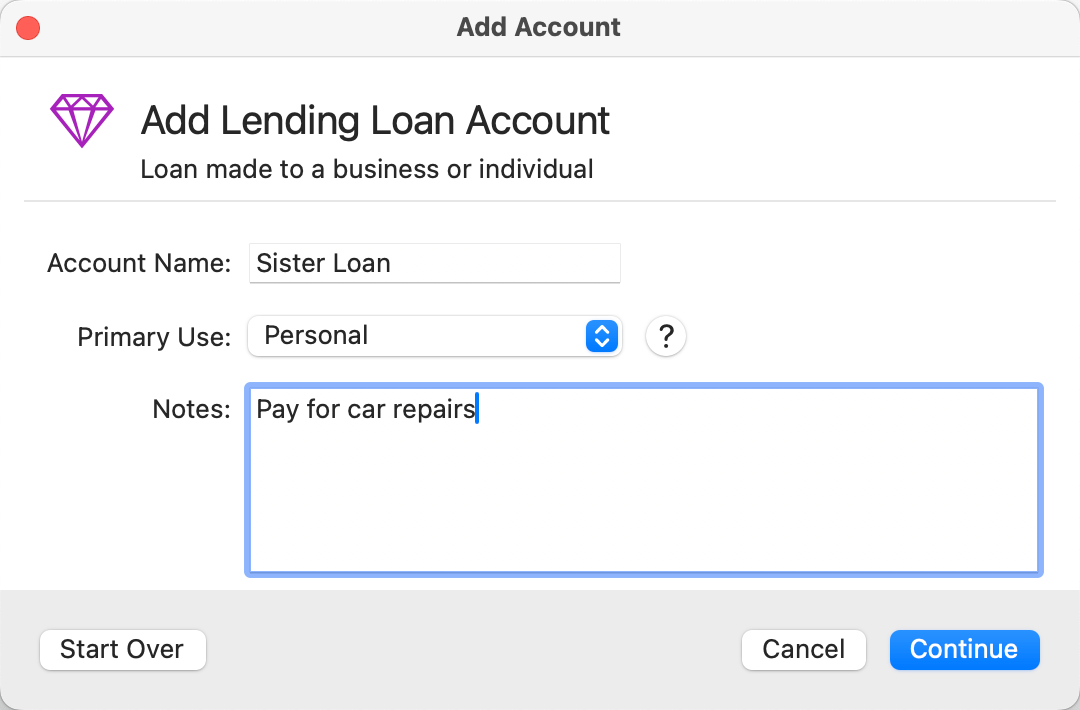

Enter the following information:

Account Name: Whatever you want to call your loan.

Primary Use: Personal or Business. If you select Business, the asset will be tracked using business categories.

Notes: Any additional information for the loan.

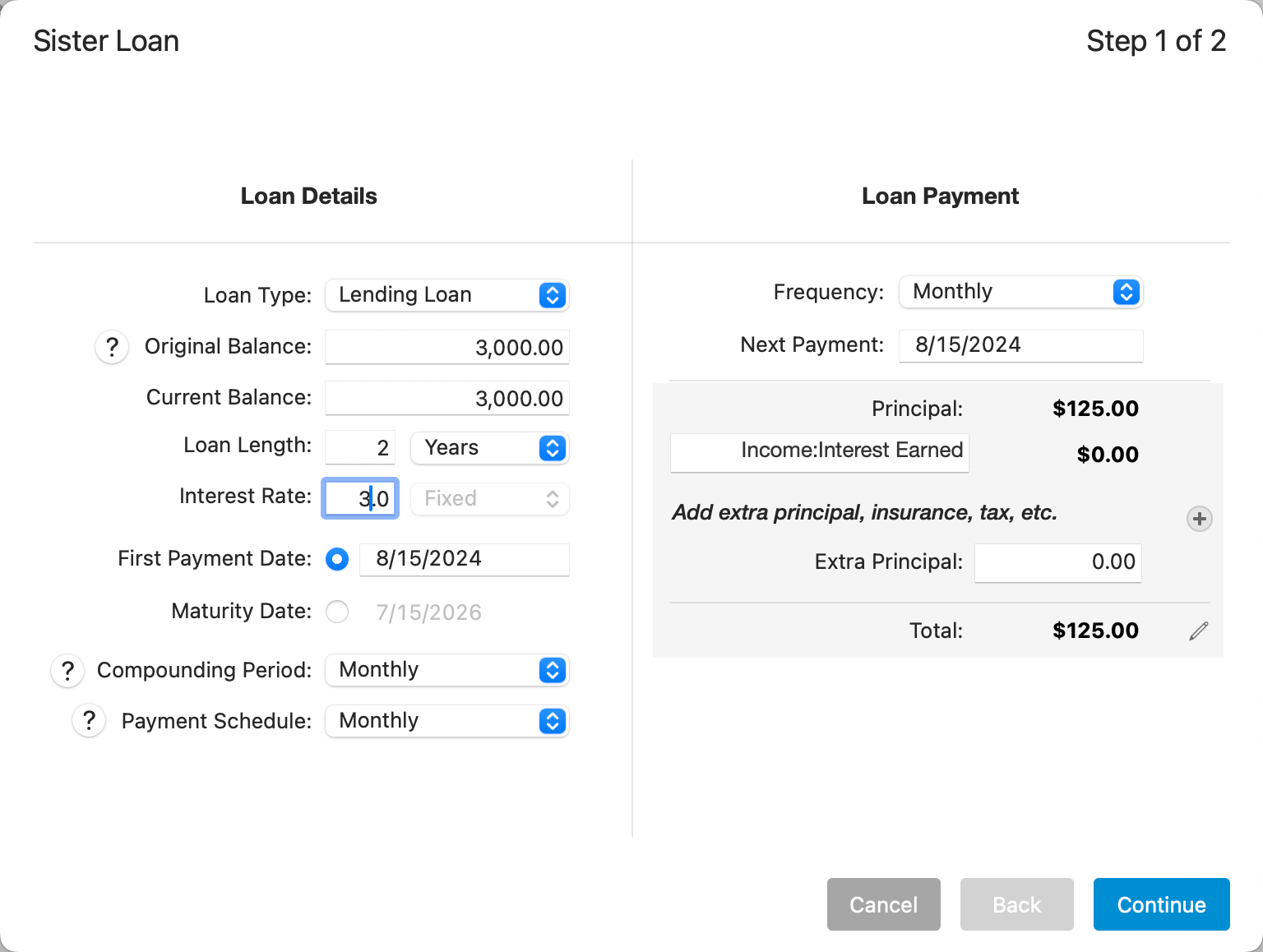

On the loan details form, enter all of your information about the loan, then select Continue.

Original Balance: Enter the total amount of money lent to the borrower at the start of the loan. This represents the initial loan amount before any payments are made.

Current Balance: This field displays the remaining balance on the loan after any payments have been made. It is automatically recalculated as payments are applied to the loan.

Loan Length: Specify the duration of the loan. Enter the length of time (Years, Months, Weeks, Payments) over which the borrower will repay the loan.

Interest Rate: Enter the annual interest rate for the loan. This rate determines how much interest will be charged on the outstanding loan balance.

First Payment Date: Select the date on which the first loan payment is due. This is the start of the payment schedule for the loan.

Maturity Date: This field displays the date when the final loan payment is due, marking the end of the loan term. It is automatically calculated based on the loan length and first payment date.

Compounding Period: Choose the frequency with which interest is calculated and added to the loan balance. Your options include daily, monthly, semi-annually, or annually.

Payment Schedule: Select how often the borrower will make payments on the loan. Typical options include monthly, quarterly, or annually but we include many options.

Frequency: This field defines how often loan payments are made, aligning with the payment schedule chosen.

Next Payment: Displays the due date of the next loan payment.

Principal: This amount is automatically calculated based on your previously entered information.

Extra Principal: Enter any additional amount the borrower intends to pay towards the loan principal, on top of the regular payment.

Total: This field shows the total amount of the upcoming payment, including both principal and interest, as well as any extra principal added.

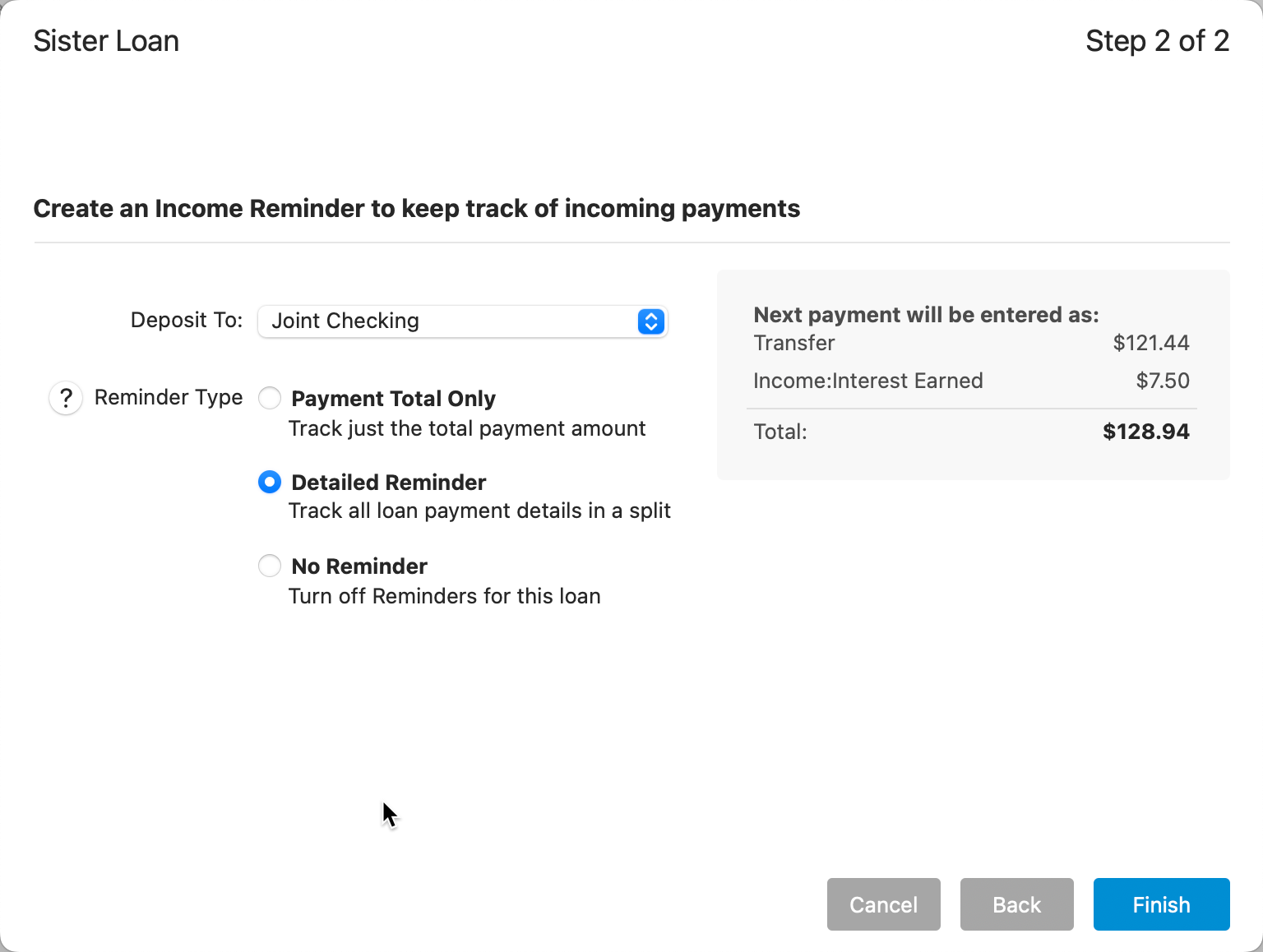

You can choose to create an income reminder and select an account to which the payments will be made.

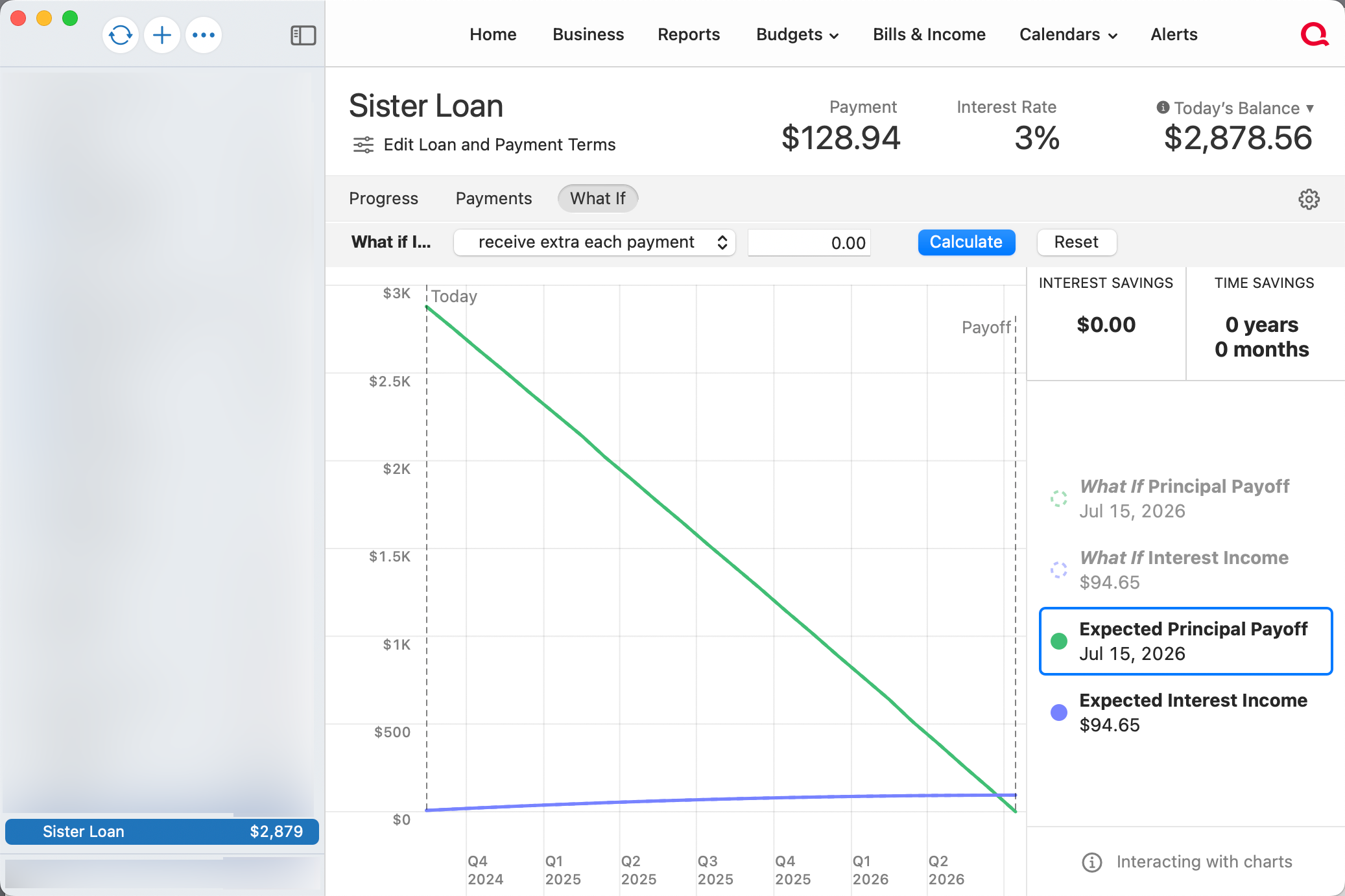

Select Finish. Your loan will appear under the Property heading on the sidebar. Select the loan on the sidebar to view information about the loan including Progress, Payments, and a What if calculator.