Tell me about key investment performance calculations used in Quicken

How is average annual return calculated in Quicken? What's an example of how return on investment (ROI) is calculated? View formulas, expanded definitions, and examples for key investment metrics. This feature is not available in Canada.

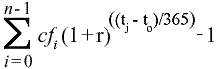

Average annual return (IRR)

The formula Quicken uses to calculate average annual return is:

| where: |

| cfi = cash flow or dollar amount of the ith transaction |

| to= date of the ith transaction in days |

| n = number of transactions for this security in the report range |

| tj= number of days in the report range |

| r = rate of interest (solving for r) |

Definition

Often called the internal rate of return (IRR), the average annual return is usually defined as a percentage equal to the interest rate on a bank account that would give you the same total return on your investment. It takes into account money earned by the investment (interest, dividends, capital gains distributions) as well as changes in share price. Because it is an annual rate, it acts like a bank interest rate that compounds annually. For example, if you invest $10,000 and get an average annual return of 12.0 percent over two years, you'll have $12,544 (an increase of $2544, or 25.4 percent) at the end of the two years.

Quicken displays the average annual return in the Investment Performance report and graph, in Portfolio columns, and in the Average Annual Return snapshot. A negative value indicates a loss, which can be either paper or real. If the return seems surprisingly high, it could be because you've set a short date range.

Amount invested

Amount invested is the actual dollar amount that you've invested in a security to date. Amount invested includes any expenses (such as commissions and fees) for that security. It does not include reinvested amounts, such as reinvested dividends, interest, or capital gains distributions.

By default, Quicken calculates the amount invested over your entire account history. Quicken can also report the amount invested for a specified date range. Change the date range by changing the Portfolio's From or As of date or by using the standard Portfolio columns Amount Invested 1-/3-/ 5-Year and Amount Invested YTD.

When you change the Portfolio date range, Quicken calculates the amount invested during that period to be the difference between the beginning amount and ending amount of the date range:

- Beginning amount: For shares purchased before the beginning date, Quicken uses the market value on the beginning date. For shares purchased after the beginning date but before the ending date, Quicken uses the actual cost of those shares.

- Ending amount: Quicken uses the market value on the date you specify. (Shares purchased after the ending date are not included in the amount invested.)

When the Amount Invested changes, so do the calculations for Return and ROI (%), which are based on the amount invested.)

Amount invested doesn't decrease when you sell shares (unless you sell all shares of a given security—then it goes to zero), whereas cost basis does. If calculations such as ROI appear lower than you would expect, it could be because the amount invested includes the cost of shares you no longer own.

Cost basis

Cost basis equals the total cost to you of a security you purchased. It includes commissions, fees, and mutual fund loads. It also includes all purchases, even reinvestments of dividends and capital gains distributions. However, it excludes the cost of any shares you've sold or given away. Also, it is reduced in a return-of-capital transaction.

Notes

Quicken assumes, unless you tell it otherwise, that the shares you sell are the ones you've had the longest. You can tell Quicken which lots (or portions of lots) to sell when you enter a Sell transaction.

After you set up a Quicken investment account, Quicken keeps track of the cost basis of each security. It takes the dollar amount you enter for the first transaction involving a given security and uses this as the cost basis as of the date of the first transaction. Subsequent purchase costs are added to the cost basis; the cost of shares subsequently sold and any return of capital are subtracted from it.

To see your lots and cost basis at any time, open the Portfolio (choose Investing tab > View > Portfolio) and expand the security you want information about.

Return

Return represents the total return of a security: the current market value, plus the income taken out as cash, plus cash received from sales of shares, minus the amount invested.

Reinvestments are not explicitly added to the return, because they contribute to the market value, which is already factored in.

Note that Return (%) YTD is based on downloaded data and is not affected by changes in the As of date option.

Example

Let's say you bought 100 shares for $5 each ($500 total). You later sold 50 shares for $6 each ($300 total). Now the market price of your 50 remaining shares is $7 ($350 total).

The return is $350 (current market value), plus $300 (sales), minus the $500 you invested, for a total return of $150.

Return on investment (ROI)

Return on investment, or ROI, is defined as return divided by amount invested. ROI indicates how well a security has performed: it is the total profit (if ROI is positive) or loss (if ROI is negative) you would have from a security if you sold your shares in it today. ROI is expressed as a percentage of the amount you invested in the security.

The ROI calculation includes price appreciation of your shares (as of the most recent available market price), plus dividend and other income you received, plus realized gain from shares you've sold.

Let's say you bought shares for $100 and received $5 in dividends, and today the shares are worth $120. The amount invested is $100, the return is $25 ($5 dividends plus the increase in market value). The ROI is 25/100 = 0.25, displayed as 25 percent.

Simple example

- John's amount invested in stock ABC from 12/31/96 to 1/4/98 is (100 x 10) + (50 x 15), or $1,750.

- John's return in stock ABC from 12/31/96 to 1/4/98 is $3,040 - $1,750 (current market value - amount invested), or $1,290.

- John's ROI in stock ABC from 12/31/96 to 1/4/98 is $1,290/ $1,750 (return /amount invested), or 73.71%.

Example with Sell and ReInvDiv

| On this date | You made this transaction | At this price per share |

|---|---|---|

| 12/31/98 | Bought 100 shares | $10 |

| 7/31/99 | Bought 50 shares | $15 |

| 12/31/99 | Received a dividend of $40, which you reinvested in two more shares | $20 |

| 1/4/00 | Sold 20 shares | $18 |

- Your market value in stock XYZ as of 1/4/00 is 132 shares x $18/share (number of shares you own x current market price per share), or $2,376.

- Your $ invested in stock XYZ from 12/31/98 to 1/4/00 is (100 x 10) + (50 x 15), or $1,750.

- Your $ return in stock XYZ from 12/31/98 to 1/4/00 is 2376 + 360 - 1,750 (current market value + cash received from sale of shares - amount invested), or $986.

- Your ROI in stock XYZ from 12/31/98 to 1/4/00 is 986/1,750 (return/amount invested), or 56%.

How ROI works in Quicken

If you change the date range in the Portfolio, the ROI also changes. That is because the date range helps determine the amount invested and return values, which are used in ROI calculations. When you change the From or As of date, you're effectively using a different date range and/or closing price.

Amount invested doesn't decrease when you sell shares; cost basis does. If calculations such as ROI appear lower than you would expect, it could be because the amount invested includes the cost of shares you no longer own.

Note for our Canadian Customers

The following terms will be different in the Canadian releases of Quicken.

Canada: "Cheque" / United States: "Check"

Canada: "Colour" / United States: "Color"

Canada: "Centre" / United States: "Center"

Canada: "Realise" / United States: "Realize"

Canada: "Behaviour" / United States: "Behavior"

Canada: "Analyse" / United States: "Analyze"