About restricted stock units

What is a restricted stock unit?

A restricted stock unit (RSU) is a type of compensation issued by an employer to an employee in the form of company shares. The company uses a vesting plan with a distribution schedule to issue restricted stock units to employees after they achieve their performance milestones or after remaining with their employer for a particular time. RSUs give employees interest in company stock but with no actual value until vesting is complete.

RSUs are assigned a fair market value (FMV) once they vest. RSUs are counted as income once vested, and the employer commonly withholds a portion of the shares to pay income taxes. The employee receives the remaining shares and can then sell their shares if desired.

You can use RSUs only with Quicken Premier and Quicken Home & Business.

Entering an RSU Grant

Although you can enter RSU grants in any investment account, Quicken recommends that you set up a separate offline investment account to track your RSUs.

- Select the Add Account icon on the top right of the Account Bar.

You can also add a new account by selecting Tools → Add Account from the top menu. - Select Offline Account → Other Investments.

- Select RSUs (Restricted Stock Units).

- Enter the following information:

- Account name (And name that will identify the account to you)

- Used for:

- Personal Transactions (not part of your business. This is almost always the choice)

- Business transactions (If RSUs were issued to your business)

- Currency

- Select Finish.

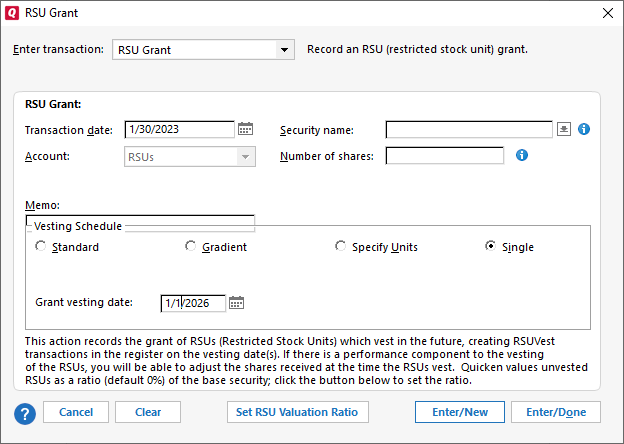

Once you have a brokerage account ready, set up your RSU Grant.

- Select the name of your RSU account in the sidebar.

- Select Enter Transactions.

- For Enter Transaction, select RSU Grant.

- Enter the details:

- Transaction Date

- Security Name

- Number of Shares

- Vesting Schedule

- Standard – The first-year vesting is at x percentage, and other shares will vest equally over the remaining vesting period.

- Gradient – The RSU will vest at different percentages over the vesting period. You will need to enter the percentages for each year.

Specific Units - Specify the number of units that vest per year.

Single - Add a single vesting date for all shares

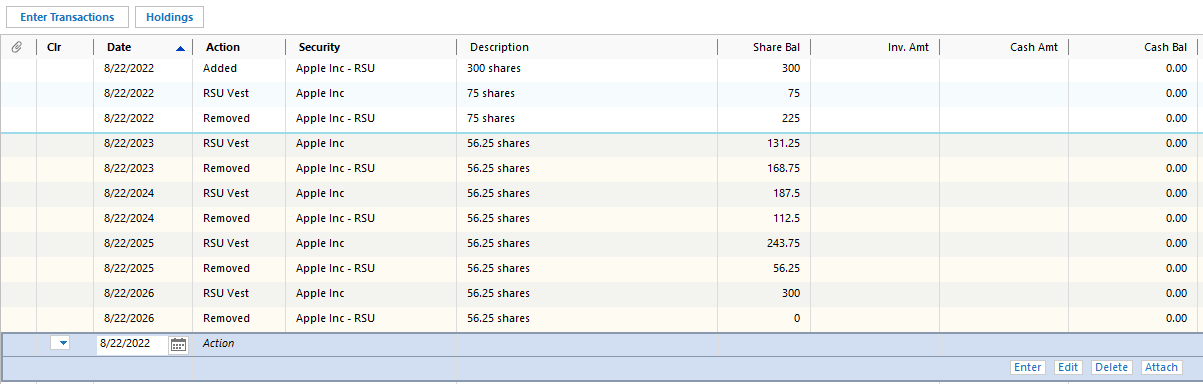

- Choose either Enter/New if you have additional transactions or Enter/Done if this completes your transactions. The vesting schedule will be represented in the investment register as a series of transactions corresponding to the dates your RSU will vest.

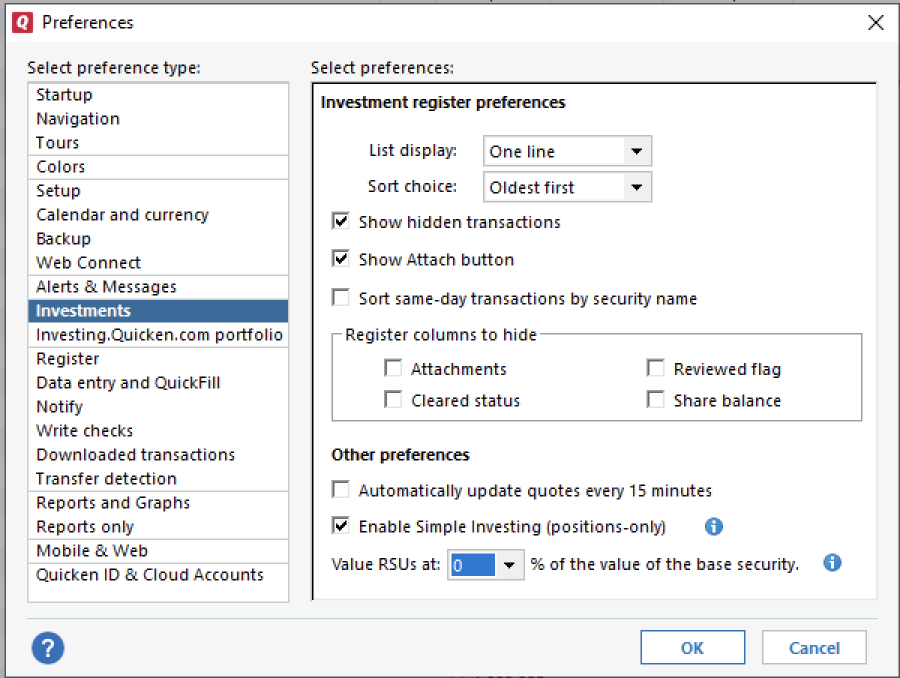

Setting the Value RSUs preference

By default, the valuation percentage for RSUs is set to 0%, which means account values, reports, and the portfolio view won’t show any value associated with RSUs.

Valuing the RSUs at 0% is conservative, reflecting that the RSUs have not vested. If you are confident that your RSUs will vest, you may choose to set this percentage to 100% of the value of the underlying ("base") security, or to an intermediate percentage – perhaps 65% to allow for tax payments of 35%. In these cases, the percentage is multiplied by the price for the underlying security to determine the value for the RSUs. For example, if you have 100 RSUs for a security whose value is $50 per share, and you set the RSU valuation preference to 60%, Quicken will show the value as $3,000.00 (100 x $50/share x 60%).

If you run a report for a future date, or set the portfolio view to a future date, some RSUs may have reached their vesting event and been replaced with the underlying security; in this case the value of that underlying security will be displayed based on the most recent available price, which is not affected by the RSU valuation preference. Likewise, if you set the account bar to display "ending balance" rather than the current balance, the balance for the account containing the RSUs will reflect the value with all RSUs replaced by the underlying security.

To change the Value RSUs preference:

- Select Edit menu → Preferences.

- Select Investments in the sidebar.

- At the bottom of the screen, select the percentage for Value RSUs at:

- Select OK.

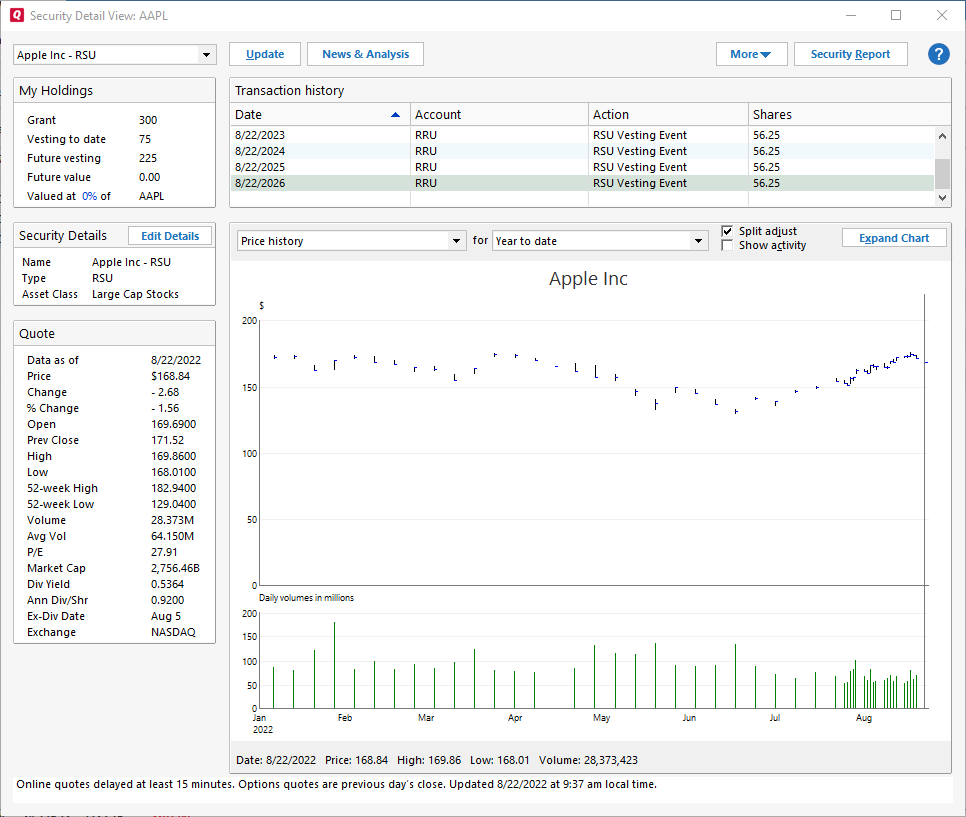

RSU Security Details View

An RSU Security Details View shows the grant, your vested shares, future vesting, and the future value based on how you set your Value RSUs preference above.