Selling securities

Use the Sell transaction type to record shares sold. When you select this transaction type, this increases your cash balance by the total amount entered for the transaction.

To Record a Sell

- In the sidebar, select the investment account you want to use.

- Click the Transactions tab and then click the New Transaction icon in the register toolbar.

- Select Sell from the Types list.

- Add the information for:

- Date - Enter the date of purchase. This is important if you want to track complete investment performance and tax information.

- Security - Select the security for which you are selling shares.

- Total Sale - Enter the total amount received after selling the shares, including commission amount.

- Number of Shares - Enter the number of shares sold.

- Commission - Enter the amount paid towards commission, per share. Based on the amount entered as commission, the price per share is adjusted.

- Memo - Enter the note you want to associate with the transaction.

- Tags - Enter the tags that you want to use while searching the transaction.

- To add an attachment, go to the Attachments tab, click the Add attachment button, and select the file you want to attach to the transaction.

- Click Save when you are done.

Default Lot Assignment

By default, when a sale is made, Quicken will use the lot assignment designated in the account settings. You can define FIFO (First-In-First-Out) or LIFO (Last-In-Last-Out) assignment. This determines which lot is used when selling a security.

- Go to Accounts > Settings

- Under Cost Basis you'll see options for Stocks, Mututal Funds, Bonds and Other.

- Select the default lot assignment you'd like to use for each type of security and Quicken will use these settings when this type of security is sold.

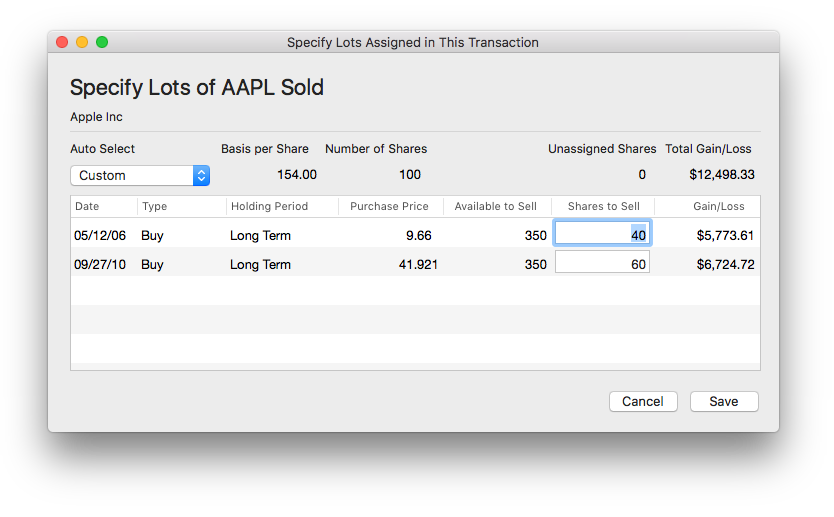

Explicit Lot Assignment

More advanced investors may want to specify which lots are assigned to the sale for tax optimization.

- Click Specify Lots in the Sell transaction.

- Select Auto Select for lot assignment options:

FIFO (First-In, First-Out)

In a FIFO system, the oldest items are the ones that get sold first. This is common in businesses where goods are perishable, like food industries. Using FIFO means the oldest stock (first to be received) gets sold first, ensuring that you don't have old stock lying around.

Example: You buy 10 units of Item A at $1 each. Then you buy another 10 units of Item A at $2 each. If you sell 15 units of Item A, FIFO would dictate that the first 10 units sold are the ones bought at $1, and the next 5 are from the batch bought at $2.

LIFO (Last-In, First-Out)

In a LIFO system, the newest items are the ones that get sold first. This is less common but might be used in industries where items are non-perishable, or where the cost of holding inventory is high. LIFO is more likely to leave older items in stock.

Example: You buy 10 units of Item A at $1 each. Then you buy another 10 units of Item A at $2 each. If you sell 15 units of Item A, LIFO would dictate that the first 10 units sold are the ones bought at $2, and the next 5 are from the batch bought at $1.

- Minimum Gain - This option will select the lot that will result in the smallest amount of gain.

- Maximum Gain - This option will select the lot that will result in the largest amount of gain.

- Custom - This option appears when selecting different lots for sale that don't match any of the other options.

- You can also enter the number of shares to sell for each lot under the Shares to Sell column.