Primary Use: Business vs. Personal

Quicken's Business & Personal tier is here for those times when our wallets don't discriminate between personal splurges and business spending. It understands that you might tap your personal credit card for a business expense or vice-versa. With Quicken, you can effortlessly sort and categorize these mixed transactions.

Whether you're manually penciling in a new account or syncing up with a bank connection, Quicken presents the Primary use choice. As Quicken pulls in accounts during the sync, you'll be asked about the Primary use. This ensures each account is tracked as Personal or as a part of your business. Accounts earmarked as Personal find their spot in the regular section of the sidebar, and the business-marked ones appear under the Business heading.

Setting your account's primary use

When diving into B&P, you'll want to identify your business accounts. To do this:

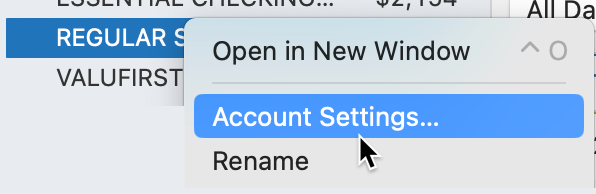

- Control-click on the account in the sidebar and select Account Settings.

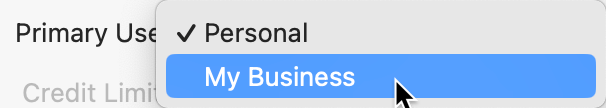

- Under Details you will see a field for Primary Use. Set the use to My Business or the name of your business. If you have multiple businesses, you'll have multiple choices.

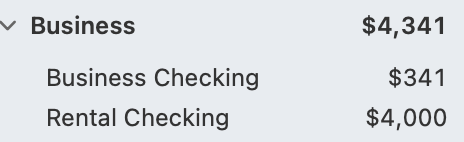

- Click Save. The account will now appear in the Business section of your sidebar.

Keeping business in Its own section

Opting for a business in Primary use? Quicken will add that account business group on your sidebar so you can see it and track it separately. So, while your personal accounts stay in their usual space, the business accounts are set in their own space. Whether it is a checking, savings, or credit card account, designating it as a business will move it to the business section of the sidebar.

What if I use my business account for personal spending or my personal account for business spending?

One of the reasons we call it Primary use is that many accounts are not exclusively used for business or personal transactions. You may pay a business expense with a personal account or buy something for yourself using a business account. Quicken understands that. You can change the nature of a transaction by changing the category. If the category is for a personal transaction, Quicken will record it as a personal transaction even if the Primary use of the account is Business. The opposite is also true. You can categorize a transaction in your personal account with a Business category, which will be included in your Business tracking and reporting.

You can even use the Split transaction feature if a transaction is partially for Business and partially Personal.