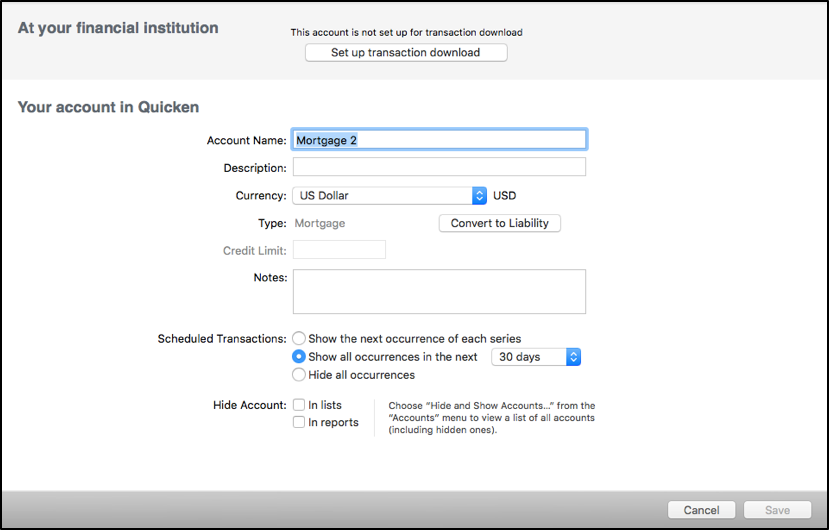

Loan settings

When you click on the gear icon on the initial screen or from the main page, you can update some of the basics about the loan.

At your financial institution – If you added the loan manually, you can go in and link to the account so that your remaining balance can be downloaded automatically for you. Remember, this is not your payment information, which updates based on your banking information and bill payments.

Account Name – You can change the default name to something that can more easily identify the loan.

Description – You can add some details to help you remember what the loan is (it’s a great way to distinguish between different loans of the same type, like two car loans, you can add details here to more quickly determine which car is being tracked).

Currency – If the loan is in a different currency, you can change it from USD to whatever the currency should be for the loan.

Type – This is not changeable on this menu, but you can update it from the Add Loan Terms button (if you have not set up your loan details yet) or from the Edit Loan and Payment Terms on the main page of the loan.

Convert to Liability – If you decide you don’t want to track the details of your loan, you can convert it to a liability account.

Credit Limit – This is not applicable for loans.

Notes – You can add any notes about the loan that will help you remember things that you may otherwise forget, such as payoff goals.

Scheduled Transactions – You can show or hide payments in the account register.

Hide Account – You can hide the loans on the left menu if you don’t want them to display with your other accounts. You can also hide loans that you have paid off but don’t want to delete so that you have them for your records.

If you make any changes, make sure to click Save when you are done.