Adding loan terms

Loan terms include essential details such as the original loan amount, current balance, loan duration, and payment frequency. You can also add extra principal payments, escrow amounts, and other associated fees. Setting up loan terms correctly helps you manage payments efficiently and ensures that scheduled transactions reflect the correct amounts.

After adding a loan, you must enter its terms to track key details like the loan balance, interest rate, payment schedule, and additional charges. This ensures accurate financial tracking and allows the system to calculate your remaining balance, principal, and interest payments. You typically enter this information when you create the account, but if any details are missing, you can complete them by following the instructions below.

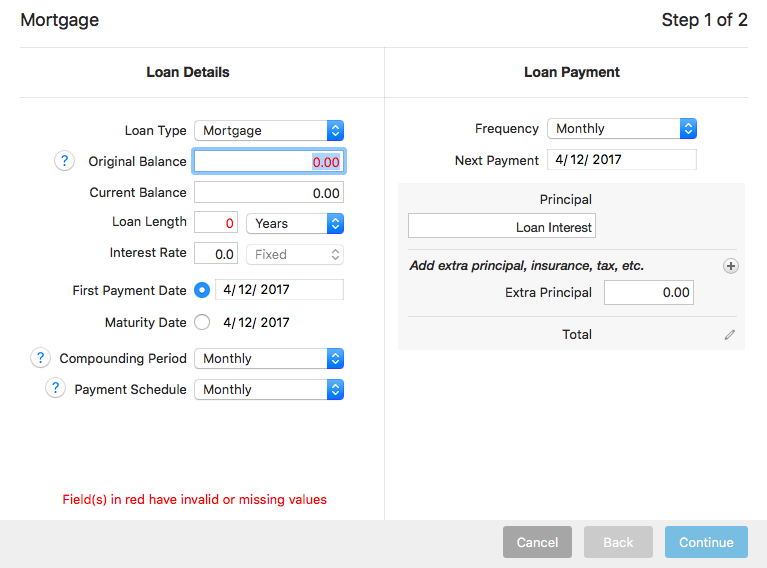

Enter loan details

The loan details section includes fundamental information about your loan, such as the balance, term length, and interest rate. Some fields are required to ensure accurate tracking.

Select the loan account you want to edit from the sidebar.

If the loan terms are incomplete, you will see the Loans screen. Select Add Loan Terms.

Enter the loan details.

Some fields are required for accurate tracking.

Loan details

Loan type – Select or update the loan type. (Required)

Original balance – Enter the initial loan amount excluding interest. (Required)

Current balance – Enter the latest balance. (Required)

Loan length – Choose a term and time increment:

Years

Months

Weeks

Payments

Interest rate – Enter the agreed-upon rate from your loan documents.

Select the compounding period:

None

Daily

Monthly

Semi-annually

Annually

First payment date – Enter the date of your first payment.

To track by the final payment, select Maturity Date instead.

Maturity date – Enter the final payment date (or use the First Payment Date if unknown).

Compounding period – Select how often interest is calculated.

Payment schedule – Choose how often payments are due. (Default: Monthly)

Define loan payments

In this section, you define how and when payments are made. The payment schedule, principal, and interest amounts are essential for tracking your loan’s progress.

Payment frequency – Select how often you plan to make payments. This may differ from the Payment Schedule if you make multiple payments per period.

Principal – The portion of the payment that reduces your loan balance. (Auto-calculated)

Interest – The portion of the payment that goes to the lender. (Auto-calculated)

Additional payments and charges

If your loan includes additional fees, such as escrow, insurance, or PMI, you can add them here.

Extra principal payments – Enter additional payments toward the principal.

Additional charges – Click + to add recurring charges, such as:

Insurance

PMI

Escrow

Other fees

(You can add up to four charges and remove any unnecessary ones.)

Total payment – Displays your full loan payment.

If the total is slightly off (by a cent or two), click the pencil icon to adjust it manually. The system will recalculate the amounts.

Click Continue.

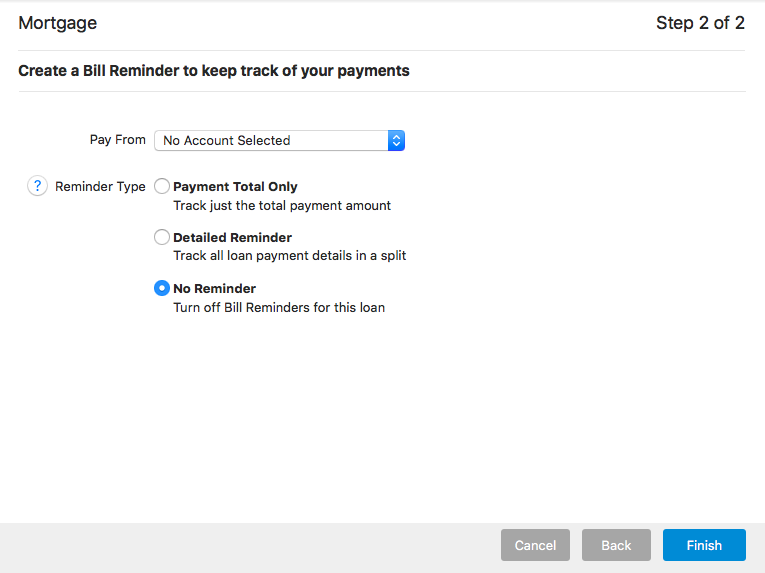

Select the account for loan payments.

Choose a reminder type.

Select payment and reminders

You can set up reminders to help track loan payments and ensure they are recorded properly. Choose a reminder type based on your preferences.

Pay from – Choose the account used for loan payments.

Reminder type – Select how to track your payments:

Payment total only – Schedules a transaction for the full payment but does not split principal and interest.

Detailed reminder – Schedules a split transaction for principal, interest, and additional charges. Future transactions update automatically based on the remaining balance.

No reminder – No scheduled reminders. Use this if you have automatic payments.

Click Finish to save your loan terms.