About Quicken budgets

A budget lets you set monthly goals for how much you expect to spend (or earn) and then track your progress against that goal.

The 12-Month Budget allows you to set up a comprehensive, yearly plan. You can budget recurring income and expenses, seasonal variations, infrequent events like tax payments, or special events like Vacations or Holiday plans. On the budget setup view, you can see your 12-month plan, including the net of your inflows and outflows per month, as well as the cumulative yearly total.

Once your budget is in place, the budget view allows you to track your progress as the month progresses. Highlighting areas where you overspend (or spend less than expected) by month, drill down to see the actual spending in a particular category or see cumulative year-to-date total to see how you’re tracking across multiple months.

You can edit, change or update your budget at any time. You can also create multiple budgets to track different aspects of your financial life. For example, if you don’t need a comprehensive budget, you might want to create a budget just to track your various entertainment expenses, or just your work or small business income and expenses. Or, you might want to create separate budgets for different members of your family.

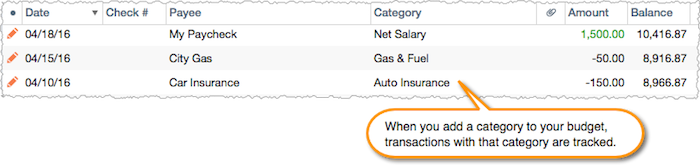

Categories: A key concept for budgeting in Quicken

Quicken budgets are based on your categorized transactions. You create your budget by selecting the categories you’d like to track in your budget. Then, categorized income and expense transactions from all accounts will be included in your budget for that category. (Note: From investment accounts, only cash transactions for which you can apply a category are included.)

If you see a transaction that is impacting your budget and has been miscategorized, you can change the category in your account register.

Special categories

Transfers are a special type of category because these types of transactions can cancel each other out if they appear in 2 different accounts. For example, if you transfer $50 from your checking account to your savings account, the transaction will appear as an "expense" of -$50 in your checking account and an "income" of +$50 in your savings account. The result will calculate to be $0 in your budget when Quicken adds both these transactions together which doesn't really help you when you're budgeting. For the transfers you want to budget, we recommend using a linked transfer where you select the account where your money is being transferred to. This way, when you select the category to budget you can select the specific account and the side of the transfer you want to budget whether it's money leaving an account or going to an account.

A few “special” categories that cannot be added to a budget:

- Adjustment

- Transfer

- Transfer: Credit Card Payment (or any other subcategory under the “Transfer” category)