Set up a paycheck

There are several excellent reasons to track deposits (such as paychecks) and other income in Quicken:

- You can save time. Quicken remembers the details of the deposits and other income you add here so you don't need to reenter all of the same information each month.

- You can get valuable tax information. You can use Quicken's tax-planning tools and tax reports and save yourself time if you import your Quicken data into TurboTax. When you're in Quicken, you'll learn how to edit the paychecks you add now to include deduction information. To learn how, choose Help menu > Learn About Next Steps After Setup. Right now, though, all you need to enter is the net amount of your paycheck.

Set up your paycheck using the Paycheck Setup Wizard

To set up your paycheck:

- From the Tools menu select Manage Bills & Income Reminders.

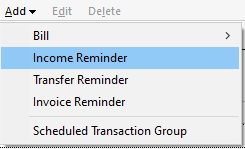

- On the Bills and Income Reminders screen, select Add menu → Income Reminder.

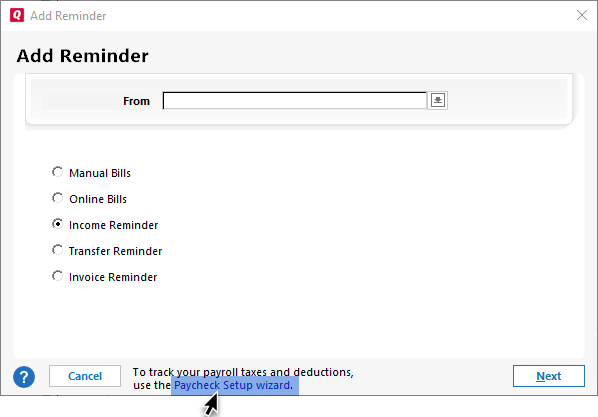

- At the bottom of the Add Reminder screen, select Paycheck Setup Wizard.

- The Paycheck Setup wizard will appear.

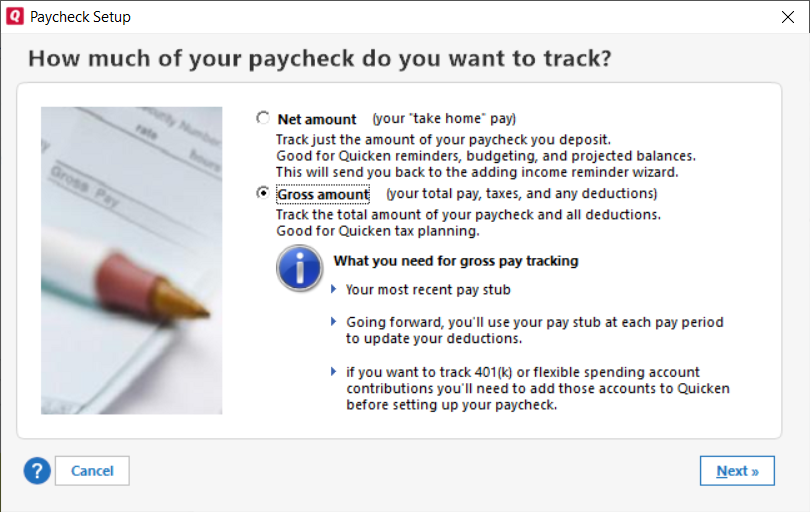

Select Gross amount.

If you select Net amount you'll be returned to the Add Reminder screen because it is a simple reminder for a specific amount.

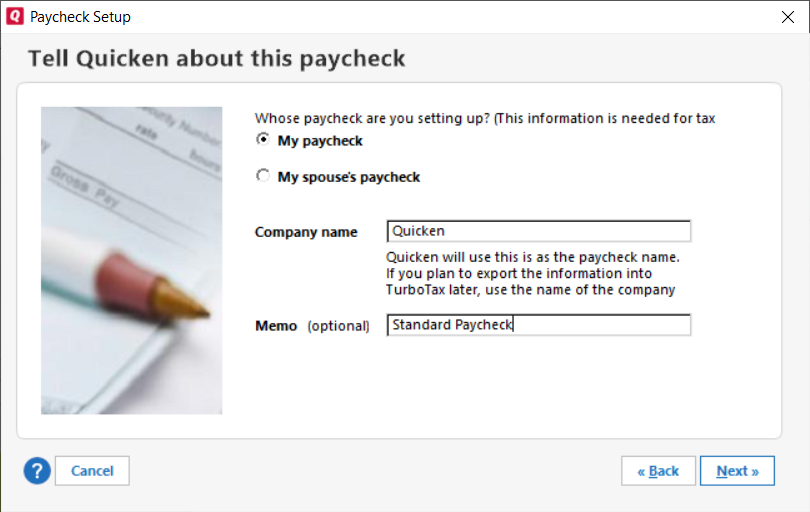

- Select whether it is your or your spouse's paycheck and enter the Company Name for the company you are getting your paycheck from. You can also enter a Memo.

- On the Track Paycheck screen, enter your paycheck recurrence date and the information from your pay stub in the appropriate fields. For specific deductions, select:

- Add Pre-Tax Deductions: Record deductions such as:

- 401(k)/403(b)/457

- PERS/SARSEP/SIMPLE

- Flex Spending

- Dependent Care

- Medical Insurance

- Vision Insurance

- Other Pre-Tax Deduction

- Add Tax Item: Record tax deductions such as:

- Federal Tax

- State Tax

- Social Security (FICA)

- Medicare Tax

- Disability (SDI)

- Other Tax

- After Tax-Deduction: Record items such as:

- Stock Purchase (ESPP)

- 401(k) Loan

- Roth 401(k)

- Employer Loan Repayment

- Other After-Tax Deduction

- Add Pre-Tax Deductions: Record deductions such as:

- When you have completed the form, select Done.

The Paycheck Setup wizard helps you enter all the income and deductions listed on your paycheck. Quicken uses this information in tax-related planners and calculators. You can even import this information into TurboTax.

The types of payroll deductions and transfers that you want to include are:

- W-2 income

- Deductions for state and federal taxes

- Pre-tax deductions, such as 401(k) contributions

- After-tax deductions, such as employee payments for health insurance

- Transfers to flexible spending accounts or employee stock purchase plans

If this is a new paycheck that you need to add to Quicken, you can follow an easy one-time setup to identify the appropriate deductions and transfers. If this is an existing paycheck that you still need to add deduction and transfer information for, then you simply need to edit the existing paycheck.

In most cases, you can use the same paycheck for as long as you stay with the employer. Each time you enter the paycheck in the register—or tell Quicken to enter it for you—the paycheck will include all the specified deductions. In the future, if there is a significant change in your paycheck amount or payroll deductions, edit the single paycheck to account for these changes.

Setting up tax-related accounts

In addition to your paycheck, consider adding these tax-related accounts.

| Quicken account | Real-world account |

|---|---|

Primary checking | Charitable and medical expensesA primary checking account is where you pay most of your bills and record any tax-related transactions, such as paycheck deposits, charitable donations, medical expenses, and nonreimbursable work-related expenses. |

Non-tax-deferred investments | Capital gains and lossesAdd at least your non-retirement accounts—any investment account where you potentially pay capital gains taxes or write off losses. |

House | Mortgage interestUse the House account and linked mortgage to track tax-deductible mortgage interest. |